IFRS 18 is effective for annual reporting periods beginning on or after 1 January 2027.

Implementing IFRS 18 is more than a technical accounting exercise – it reshapes how organisations present performance, communicate results and tell their financial story. But interpreting new presentation and disclosure requirements and preparing for audit can stretch resources within finance teams.

We provide practical, hands-on IFRS 18 advisory support to help you plan early, implement the new standards with confidence and keep reporting on track as standards evolve.

Combining pragmatic technical accounting advice with disciplined programme delivery and financial reporting support, we help you reduce surprises during your audit and present clearer and more meaningful financial information to stakeholders.

We can help with

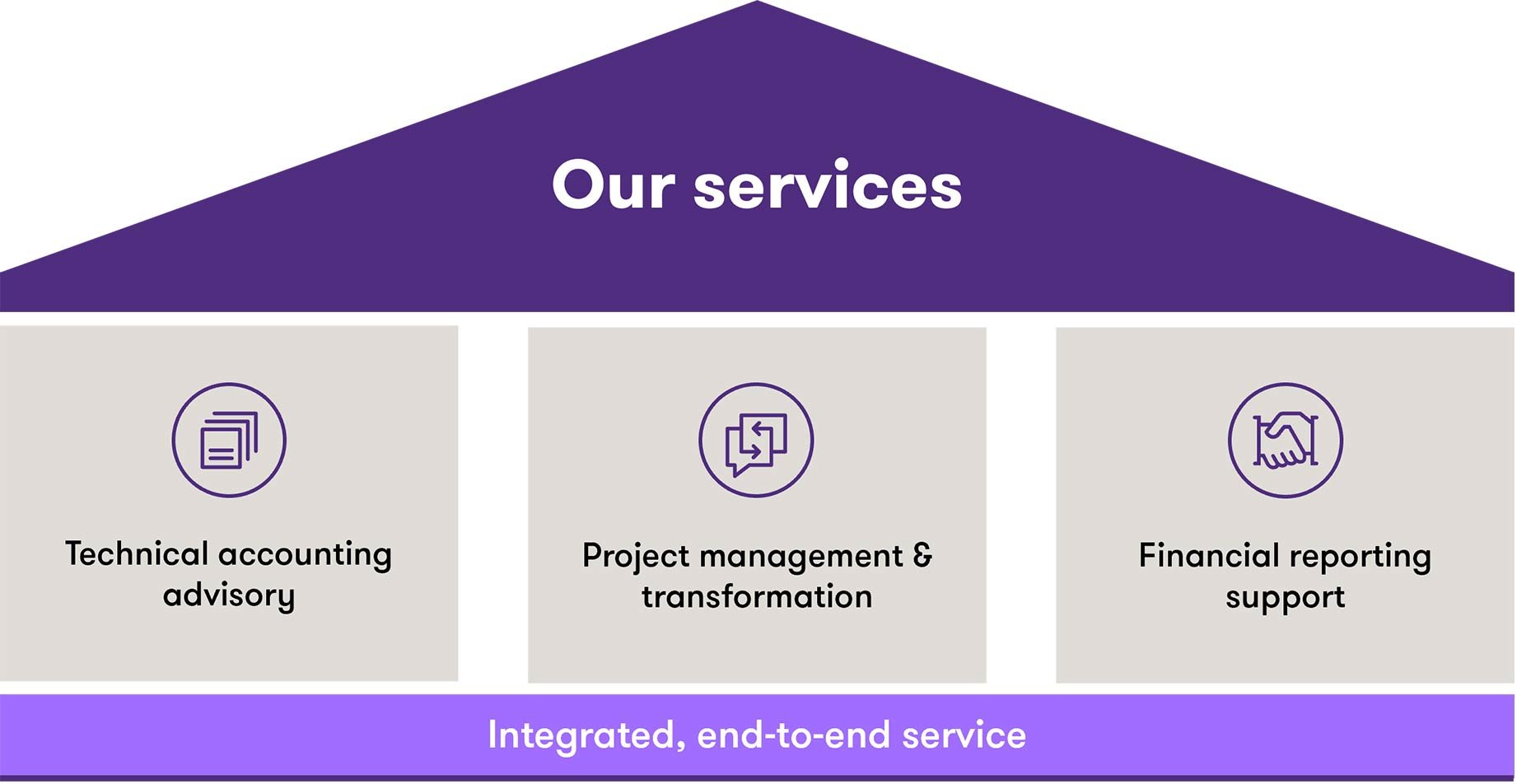

We offer an integrated, end-to-end service across three pillars, helping your finance function and wider business stay IFRS 18 ready.

Technical accounting advisory

- Interpretation of the IFRS 18 requirements and how they interact with existing standards and the consequential amendments

- Assessment of presentation categories, mandatory subtotals and mapping from the current chart of accounts

- Identification of key judgement areas and disclosure drivers

- Practical guidance on transition and comparative reporting

- Worked examples, accounting memos and technical papers suitable for external audit review

- Coordinate with your tax team on how tax reporting processes may be affected

Project management & transformation

- Programme and project governance tailored to your organisation

- Gap analysis across existing accounting policies, systems, reporting packs, dashboards, tax and internal controls

- Translation of technical requirements to systems, covering ERP/GL, consolidation tools and reporting engines; definition of data lineage and reconciliation points.

- Systems configuration support and vendor engagement

- Change management and training

- Transition rehearsals, mock audits and cutover support to ensure a smooth go live and consistent comparative disclosures

Financial reporting support

- Redesign of statutory financial statements, internal management reports and KPI dashboards to align with IFRS 18 presentation

- Preparation of disclosure checklists, note templates and reconciliations for audit review

- Drafting of board papers, investor Q&A and transitional disclosures

- Support for interim and quarterly reporting requirements

- Post-implementation support including reviews, control testing and ongoing enhancements

Assess your organisation’s readiness across accounting, reporting and implementation considerations.

Why Grant Thornton

We know that every business is unique, so we work closely with you to understand your needs wherever you're at. We’ve worked with organisations from different sectors for their IFRS financial statements, and can tap on our past experience to bring you deep insights and tailor practical solutions that help you achieve your objectives.

Best of local and global insights

Bringing finely tuned local knowledge together with global expertise from over 150 markets in the Grant Thornton network, we help you see the bigger picture so that you can make your next move with confidence.

Practical IFRS expertise that delivers

Our experienced technical accountants bring deep knowledge of primary financial statements and related consequential amendments, so that you can navigate the evolving reporting requirements with clarity and confidence.

Hands-on, audit-aligned approach

We combine technical accounting expertise with proven programme delivery skills to prepare clear, audit-aligned documentation and technical memos, reducing iteration and supporting a smoother sign-off process.

We keep you moving forward

With a strong understanding of the regulatory expectations, we help you implement IFRS 18 efficiently and confidently – keeping your reporting on track as standards evolve.