-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

FRS 109’s introduction of the Expected Credit Loss (“ECL”) model has fundamentally changed how provisioning for credit losses is being looked at by banks and other financial institutions. The transition to expected credit loss models requires cross functional support, with expertise around risk management, finance, IT and economic forecasting, being particularly important.

Grant Thornton’s ECL modelling specialists combine such skills and help implement provisioning methodology and process which are right for your business.

Three 'S'

Three ‘S’ define the key success factors for ECL implementation, i.e.

Design of ECL model

Click on the various components of ECL below to know more about how ECL typically works

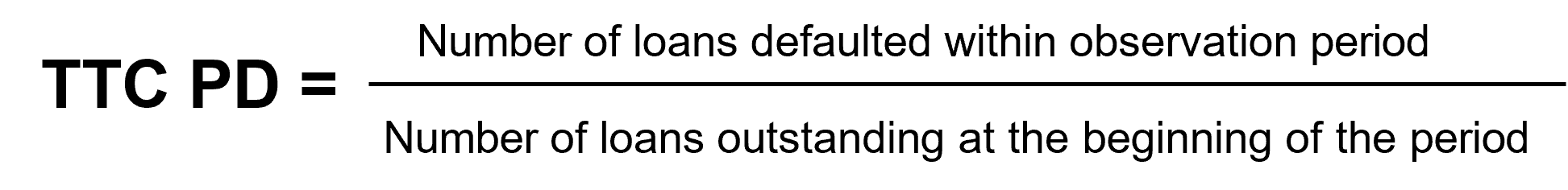

PD refers to the likelihood of a loan defaulting over a time horizon. It is further bifurcated into through the cycle PD (TTC PD) and point in time PD (PIT PD).

TTC PD is calculated as the long run average of historical defaults rates observed by the entity.

PIT PD represents forecasted PDs based on current and expected macroeconomic conditions. PIT PD is a function of TTC PD and macroeconomic variables.

Computation of PD is a complex process that involves analysis of data of years of historical experience. We leverage our proficiency in technical accounting and risk management and technological skills to implement flexible and scalable models for our clients.

We have experience of implementing several models for modelling probability of default on varied portfolios. Choice of the model depends on the nature of portfolio and system/data capabilities.

Commonly used methodologies include:

- Transition matrix

- Static pool transition rates

- Markov Chain

- Flow rates

- Vintage analysis

- Survival analysis

- PD based on credit rating

- Logistic regression

- Vasicek model

- Monte Carlo simulation

- Discriminant analysis

- Hazard models

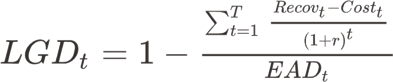

LGD is defined as the percentage of exposure that is not expected to be recovered in the event of default.

LGD is modelled by analyzing post default recoveries from loans defaulted in the past. Key considerations include considerations of nature and value of collateral, other credit enhancements and cost of recoveries.

Statistical techniques such as regression can be used to incorporate forward looking information in LGD when sufficient historical data is available.

For Stage 3 loans, time elapsed since default date should be considered while applying LGD as per the historical experience of the company.

Our approach on LGD and choice of model adapts to your products and data/ system capabilities.

Generally, the following methods are used to calculate LGD:

- Workout method

- Asset pricing models

- Market LGD

- Regulatory/ market proxies when sufficient data is not available.

EAD refers to the expected exposure to a borrower in the event of default. The methodology for EAD varies based on the nature of the product.

EAD = Current drawn exposure + (Current undrawn exposure × Credit Conversion Factor)

Exposure at the balance sheet date is the key input for EAD.

However, maturity pattern is used to model the expected changes in loan exposure over the lifetime of the asset. Entities are also required to consider the impact of expected prepayments to factor in the behavioral maturity of the asset instead of the contractual maturity.

For revolving facilities and assets with undrawn exposures, credit conversion factor (CCF) is applied to compute EAD. Entities can use workout CCF based on their own data or use regulatory/market proxies. Entities are required to consider their credit risk practices while determining the behavioral maturity for revolving facilities.

ECL reflects an unbiased, probability weighted estimate of cash shortfalls on the loan, and takes into account past events, current conditions and forecasts of future economic conditions.

While PD, LGD and EAD are the key components in ECL computation, the ECL provision is impacted by various other considerations like:

- Policy on criteria for significant increase in credit risk (SICR) and default definition

- Policy on individual vs collective assessment and segmentation

- Overlays: Upon analyzing the output of the model, Management may create additional ECL if the model output does not adequately reflect the credit risk expected in the future.

- Approach for discounting of ECL

As part of our services, we guide you through navigating the challenges faced while evaluating these considerations to ensure effective ECL implementation.

Our approach to ECL

-

![Our approach to ECL]()

Policy formation

The key policies mentioned would be agreed upon in this step.

The result of this step shall be well deliberated, and documented conclusions on these areas.

Examples of possible questions to consider include:

- At what level should segmentation of loan portfolio be done?

- What should be considered as the threshold of ‘low’ credit risk?

- What should be definition of significant increase in credit risk (SICR) and default event

-

![Our approach to ECL]()

Model development

- Design the methodology for probability of default modelling.

- Static pool transition matrix is typically done, but in case there is lack of historical data, use of market/proxy data would be necessary. For wholesale portfolio, externally available data like credit ratings is also generally considered.

- Identification of macro-economic factors that shall be considered.

- LGD models for the different portfolios is developed

- Design custom automated models, where required

-

![Our approach to ECL]()

Identification and validation of inputs

- Evaluate the various sources of inputs (both internal and external), that can be used in the models, and advise on the appropriateness of each of them.

- Evaluate the forward-looking data that should be incorporated.

- Specify the major estimates and assumptions.

- Setting up triggers and benchmarks for future update of data

-

![Our approach to ECL]()

Go live

- Develop process manual for future reference

- Document policies for formal internal approval

- Review and update the models as required

- Training and presentation to internal and external stakeholders

Subscribe for timely technical updates and keep on the pulse with industry developments