-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

Usually non-current assets are measured in the financial statements at either cost or revalued amount. However, IAS 36 ‘Impairment of Assets’ requires assets to be carried at no more then their revalued amount and any difference to be recorded as an impairment. However, its requirements of when and if to undertake an impairment review are sometimes challenging to apply in practice.

The articles in our ‘Insights into IAS 36’ series have been written to assist preparers of financial statements and those charged with the governance of reporting entities understand the requirements set out in IAS 36, and revisit some areas where confusion has been seen in practice. This article, explains if and when to undertake an impairment review.

In this article

This article explains if and when a detailed impairment test as set out in IAS 36 is required. The guidance prescribes different requirements for goodwill and indefinite life intangible assets (including those not ready for use) when compared to all other assets. As such, this article will cover Step 3 in the impairment review which is to determine if and when to test for impairment is needed.

For a summary of the steps in applying IAS 36 (including steps 1 and 2), refer to our article ‘Insights into IAS 36 – Overview of the Standard’.

Step 3: If and when an entity should test for impairment

IAS 36 requires an entity to a perform a quantified impairment test (ie to estimate the recoverable amount):

- if at the end of each reporting period, there is any indication of impairment for the individual asset or CGU (indicator-based impairment), and

- annually for the following types of assets, irrespective of whether there is an indication of impairment:

- intangible assets with an indefinite useful life

- intangible assets not yet available for use, and

- goodwill acquired in a business combination.

Timing requirements for impairment testing by asset type are as follows:

| Asset | Test if indicator of impairment present during the course of or at the end of the reporting period |

Test at least annually |

|

Yes | Yes |

| All other assets within the scope of IAS 36, but not included above. |

Yes and review the remaining useful life, the depreciation/amortisation method, and the asset’s residual value. |

No |

Indicator-based impairment testing

IAS 36 requires an entity to assess at the end of each reporting period whether there is any indication that an asset or CGU may be impaired. This requirement also applies to goodwill, indefinite life intangible assets, and intangible assets not yet ready for use (although, in practice, an indicator review is necessary only at period ends that do not coincide with the annual test). If any such indication exists, the entity should estimate the recoverable amount of the asset or CGU. The process to estimate the recoverable amount is discussed in our article ‘Insights in IAS 36: Estimating recoverable amount’.

Indicators - IAS 36 provides a non-exhaustive list of external, internal and other indicators that an entity should consider, summarised these are as follows:

External sources of information

- Observable indications of a significant and unexpected decline in market value.

- Significant negative changes (have occurred or are expected) in the technological, market, economic or legal environment.

- Market interest rates or other market rates of return on investments have increased (which will increase the discount rate used in calculating an asset’s VIU).

- Carrying amount of the net assets of the entity is more than its market capitalisation.

Internal sources of information

- Evidence is available of obsolescence or physical damage of an asset.

- Significant negative changes (have occurred or are expected) in the extent to which an asset is (or is expected to be used) (eg an asset becoming idle, plans to discontinue or dispose of the asset before the previously expected date, and reassessing the useful life of an asset as finite rather than indefinite).

- Evidence is available from internal reporting that indicates the economic performance of an asset is, or will be, worse than expected.

Other indicators

- For an investment in a subsidiary, joint venture or associate, the investor recognises a dividend from the investment and evidence is available that:

- the carrying amount of the investment in the separate financial statements exceeds the carrying amount in the consolidated financial statements of the investee’s net assets, including associated goodwill, or

- the dividend exceeds the total comprehensive income of the subsidiary, joint venture or associate in the period the dividend is declared.

- The fact that an active market no longer exists for a revalued intangible asset.

Generally, internal indicators would provide reasonably direct evidence that a specific asset or CGU may be impaired. For example, internal reports might show:

- cash flows for acquiring the asset or CGU, or subsequent cash needs for operating or maintaining it, are significantly higher than those originally budgeted

- actual net cash flows or operating profit or loss flowing from the asset or CGU are significantly worse than those budgeted

- a significant decline in budgeted net cash flows or operating profit, or a significant increase in budgeted loss, flowing from the asset or CGU, or

- operating losses or net cash outflows for the asset or CGU, when current period amounts are aggregated with budgeted amounts for the future.

However, external sources of information will more typically be broader and less clearly linked to a specific asset or CGU (for example, a decline in market capitalisation to less than the carrying value of the entity’s net assets). This then may require the use of judgement to determine which assets or CGUs should be tested in response to an external source of information. The example below illustrates this point.

BioTech Research Company (BTRC) develops and sells a range of diagnostic products. It operates from three manufacturing and distribution hubs. Each hub is considered to be a separate CGU. BTRC is preparing its financial statements for its year-ended 31 December 20X1. Summary financial information for each CGU is as follows:

| CU000s | CGU1 | CGU2 | CGU3 | Total |

| Goodwill | 1,900 | - | - | 1,900 |

| Other intangible assets (amortising) | 1,100 | 500 | 1,000 | 2,600 |

| PPE | 500 | 1,500 | 700 | 2,700 |

| Subtotal | 3,500 | 2,000 | 1,700 | 7,200 |

| Corporate HQ | - | - | - | 1,800 |

| Net debt | - | - | - | (3,500) |

| Other assets and liabilities (net) | - | - | - | (500) |

| Net book value | 5,000 |

The market capitalisation of BTRC as at 31 December 20X1 is CU3,000.

As part of its indicator assessment, management should compare market capitalisation (CU3,000) with net book value (CU5,000). Given the seemingly material ‘market to book’ shortfall of CU2,000, a detailed impairment test is probably required. However, BTRC should consider all facts and circumstances, including:

- whether some or all of the shortfall is attributable to assets and liabilities outside IAS 36’s scope (eg if the fair value of the entity’s net debt is significantly different to its carrying value of CU3,500)

- whether any discounts or premia to the market capitalisation should be considered, to reflect control and liquidity

- the volume of trading the company’s shares

- share price volatility

- length of time over which a shortfall is observed

- the reason for any notable decreases in the market capitalisation and the extent to which management information is known to the market, and

- other possible impairment indicators.

If, after considering these factors management concludes that detailed impairment testing is required, the question arises as to which CGUs and assets should be tested. CGU 1 needs to be tested for impairment in any event because goodwill has been allocated to it; however determining the relevance of the market to book shortfall for CGU 2 and 3 will require BTRC to make a judgement after considering all facts and circumstances including:

- whether there is a reasonable basis to conclude that the market capitalisation to book value shortfall relates to a specific CGU or CGUs

- the existence or otherwise of other impairment indicators for each CGU or

- the results of impairment testing for CGU 1 (if CGU 1 is impaired, the market capitalisation to book value shortfall may be reduced or eliminated).

If BTRC is unable to link the shortfall to particular CGUs it may conclude that all CGUS should be tested for impairment.

In practice, an adverse trend might develop over a series of reporting periods (eg a decline in market demand). While an entity may not be able to pinpoint a specific event or moment when an adverse trend becomes an impairment indicator, adverse trends such as this clearly cannot be ignored. Management will need to factor these types of trends into its impairment review and use judgement based on the specific facts and circumstances to decide whether the adverse trend constitutes an impairment indicator.

Review useful life, depreciation/amortisation method, residual value

The existence of an impairment indicator may also suggest that the remaining useful life, depreciation (amortisation) method or the residual value for the asset needs to be adjusted. When an entity identifies an indicator of impairment, the remaining useful life, the depreciation (amortisation) method or the residual value of the asset should be reviewed (and adjusted if necessary) even if no impairment loss is recognised.

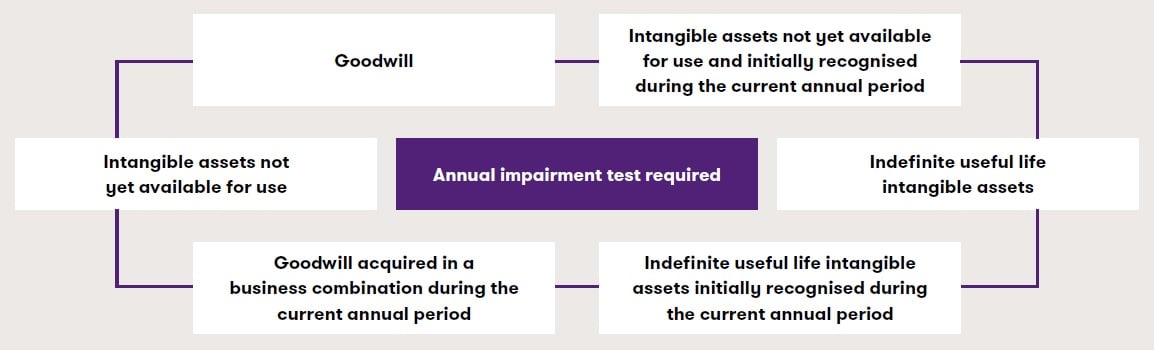

Annual impairment testing

The Standard requires an intangible asset with an indefinite useful life, an intangible asset not yet available for use and goodwill to be tested for impairment:

- when an indication of impairment exists, and

- at least annually, irrespective of indicators.

Further, the intangible asset and/or goodwill should be tested for impairment before the end of the current annual period if:

- the asset was initially recognised during the current annual period, or

- some or all of the goodwill allocated to the CGU under review was acquired in a business combination during the current annual period.

For a related discussion on the provisional allocation of goodwill, see our article ‘Insights into IAS 36 – Allocate goodwill to the cash

generating units’.

Timing of the annual impairment test

The annual impairment test for an asset may be performed anytime during the annual period provided the test is performed at the same time every year. Assets that are subject to annual testing may be tested at different dates provided the date is consistent whenever the test is undertaken. This provides some flexibility to spread the workload while providing a safeguard against manipulation.

Practical insight – Changing the annual impairment testing date

An entity may wish to change its annual impairment testing date, perhaps to align with the budget cycle or to reduce the testing burden in another period. IAS 36 is silent on this. In our view, a change of date is acceptable in reasonable circumstances subject to the entity demonstrating this has not resulted in avoiding an impairment loss. For example, an entity with a 31 December year-end might wish to change its testing date from 30 June to 31 December.

In the current annual period it could conduct tests at both dates, then test only at 31 December in the following annual period (assuming no indicators are identified at other period ends). In our view, paragraph 96 of IAS 36 serves as an anti-abuse provision which will not be breached if this approach is taken and the entity consistently tests at the new date on a go-forward basis. We do not regard moving to a new testing date to be a change in accounting policy. However, entities should consider disclosing the change and the reasons for it.