-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

This article is the third of a three-part series on cash-generating units (CGUs). In this article we discuss how to allocate goodwill to CGUs, which follows articles on how to identify CGUs and how to allocate assets to CGUs.

Identifying CGUs is a critical step in the impairment review and can have a significant impact on its results. That said, the identification of CGUs requires judgement. The identified CGUs may also change due to changes in an entity’s operations and the way it conducts them.

After the entity identifies its CGUs, it must determine which assets belong to which CGUs, or groups of CGUs. The basis of allocation differs for:

- operational assets

- corporate assets, and

- goodwill.

In this article

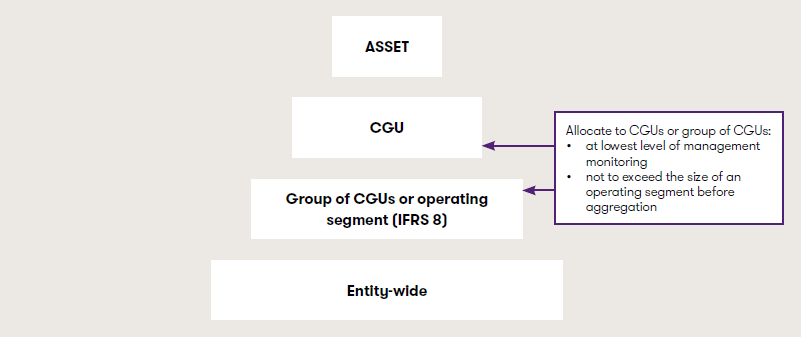

The below diagram summarises the different allocation bases for goodwill:

It is not possible to determine the recoverable amount of goodwill independently from other assets because goodwill does not generate cash flows of its own; rather it contributes to the cash flows of individual CGUs or multiple CGUs.

As such, goodwill must be allocated to individual CGUs (or groups of CGUs) for the purpose of impairment testing. The guidance in IAS 36 requires the goodwill acquired in a business combination to be allocated to each of the acquirer’s CGUs or groups of CGUs that are expected to benefit from the synergies of the combination. Further, the level to which the goodwill is allocated must:

- represent the lowest level within the entity at which the goodwill is monitored for internal management purposes, and

- not be larger than an operating segment before aggregation as defined by IFRS 8 ‘Operating Segments’.

Example 1 - Allocating goodwill acquired in a business combination

Entity A acquires competitor E for CU1M and determines that this new acquiree is a single CGU (E). Entity A performs an analysis of its existing business and determines that CGUs B, C and D will all benefit from the acquisition of E and expect to realise potential synergies from the transaction. The identifiable net assets of E total CU750,000. Total goodwill from the acquisition equals CU250,000 (CU1M – CU750,000).

Ignoring tax effects, because some of Entity A’s existing CGUs are expected to benefit from the synergies of the combination, a portion of the goodwill of CU250,000 should be allocated to these CGUs. IAS 36 provides little guidance on how to do this.

However, if Entity A is able to estimate how much of the purchase price (and goodwill) relates to expected synergy benefits for its existing business, this can provide an initial basis for allocation. For example, if the estimated fair value of E is CU800,000 (ie excluding acquirer synergies), Entity A may allocate CU50,000 of goodwill to E (CU800,000-CU750,000) and allocate the remaining goodwill of CU200,000 between CGUs B, C and D, representing the expected synergies to be generated between E, B, C and D.

Allocating goodwill to groups of CGUs

IAS 36 acknowledges that sometimes goodwill cannot be allocated to individual CGUs on a non-arbitrary basis. It therefore allows or requires allocation to groups or clusters of CGUs, subject to the limits noted above.

If management has a monitoring process for goodwill, IAS 36 seems to require goodwill to be allocated to the lowest level at which it is monitored but limits this to the size of the operating segment before any aggregation. Allocation at such a level means goodwill can be monitored using existing reporting systems consistent with the way management monitors its operations.

If there is no separate monitoring process for goodwill, IAS 36 allows a choice of allocation to:

- individual CGUs

- groups of CGUs forming part of an operating segment before aggregation, or

- groups of CGUs forming an entire operating segment before aggregation.

Example 2 - Limit on the level at which goodwill can be allocated

Entity A manufactures and sells widgets. In year 20X1, it purchases Entity B, Entity C, and Entity D which also produce widgets, each in a different part of the world. Entity A recognised goodwill of CU1M with respect to the acquisition of Entity B, CU2M with respect to the acquisition of Entity C and CU4M with respect to Entity D, all attributable to the cost-savings opportunities from using Entity A’s established centralised functions (purchasing, marketing, human resources).

Management has identified several CGUs, each of which is a component of one of entities A, B, C and D. The operating segments before aggregation for the purposes of IFRS 8 are Entities A, B, C and D as management reporting and resource allocation decisions are based on the corporate structure. Goodwill is not separately monitored.

Management can choose whether to allocate goodwill among individual CGUs that are expected to benefit from the synergies of each combination, or at the level of its four operating segments. If management determines it cannot allocate goodwill among its individual CGUs except on an arbitrary basis it should allocate it at the operating segment level.

Changes in the allocation of goodwill

For various reasons, the initial allocation of goodwill to CGUs or groups of CGUs may change. Below we discuss these circumstances and outline the appropriate accounting for each in accordance with IAS 36.

1. Provisional allocation of goodwill

The initial allocation of goodwill acquired in a business combination should be completed before the end of the annual period in which the business combination takes place, if possible. However, if this is not possible, and the accounting is incomplete by the end of the reporting period in which the business combination occurs, provisional amounts should be included for the items where the accounting is incomplete.

IFRS 3 ‘Business Combinations’ sets out guidance on provisional accounting for a business combination, including a requirement to finalise the IFRS 3 accounting within the ‘measurement period’. This period ends as soon as the required information is received about facts and circumstances that existed at the acquisition date or learns more information is not available. However, it should not exceed twelve months from the acquisition date. In our view, if goodwill has been determined only provisionally in accordance with IFRS 3, then that provisional amount should be allocated to CGUs or groups of CGUs if possible (and then adjusted as necessary when the IFRS 3 accounting is complete). However, IAS 36 acknowledges an initial allocation may not be possible, in which case the initial allocation should be completed before the end of the first annual period following the combination. For more on IFRS 3 accounting and the provisional accounting for goodwill, please see our Insights into IFRS 3 series.

In the event the entity is unable to allocate even the provisional amount of goodwill before the end of the period in which the combination takes place, it should disclose:

- the amount of unallocated goodwill, and

- the reasons why it remains unallocated.

Example 3 - Compliance with IAS 36 when an initial allocation of goodwill is not possible

Entity P has acquired a subsidiary (Entity T) on 30 June 20X0 which will be accounted for in accordance with IFRS 3. At the reporting date of 31 December 20X0, Entity P has not completed its determination of the acquisition date fair values and therefore it cannot finalise its measurement of goodwill (ie the IFRS 3 measurement period remains open and the amounts reflected in the consolidated financial statements are stated as provisional). Entity P also concludes it cannot complete the initial allocation of the provisional goodwill by 31 December 20X0.

Does Entity P have to carry out an impairment test on the goodwill prior to 31 December 20X0 in accordance with IAS 36?

Ignoring tax effects, when the initial allocation of goodwill has not been made but facts and circumstances indicate the goodwill may be impaired (eg an overpayment for the acquisition), Entity P should use reasonable endeavours to ensure the goodwill is not carried at an amount above its recoverable amount. This will ensure compliance with the overall principles of IAS 36 which require some form of recoverability test to take place.

The fact the allocation process remains incomplete does not exempt the entity from performing an impairment assessment using the best information available at the time. Depending upon the particular facts and circumstances, the form of this test may vary (for example, the entity may need to estimate the recoverable amount on an entity-wide basis).

2. Reallocation of goodwill

Various circumstances may necessitate a reallocation of goodwill among CGUs (or groups of CGUs) including:

- the disposal of an operation to which goodwill has been allocated, and

- the reorganisation of an entity’s reporting structure.

a. Disposal of an operation within a CGU to which goodwill has been allocated

When goodwill has been allocated to a CGU and the entity disposes of an operation within that unit, the goodwill associated with the disposed operation must be:

- included in the carrying amount of the operation when determining the gain or loss on disposal, and

- measured on the basis of the relative values of the operation disposed of and the portion of the CGU retained (unless another method better reflects the goodwill associated with the disposed operation).

b. Reorganisation of the reporting structure

When an entity reorganises its reporting structure in a way that changes the composition of one or more CGUs to which goodwill has been allocated, the goodwill must be:

- reallocated to the units affected, and

- measured using a relative value approach (again, unless another method better reflects the goodwill associated with the reorganised units).

Example 4 - Reorganisation of the reporting structure

Goodwill had previously been allocated to CGU A. The goodwill allocated to CGU A cannot be identified or associated with a lower-level asset group, except arbitrarily. CGU A is to be divided and integrated into three other CGUs: B, C and D.

Because the goodwill allocated to CGU A cannot be non-arbitrarily identified or associated with an asset group at a lower level, it is reallocated to CGUs B, C and D on the basis of the relative values of the three portions of CGU A before those portions are integrated into CGUs B, C and D.

Other methods that may better reflect the goodwill associated with the operation disposed of or reorganised

When an entity disposes of part of a CGU to which goodwill has been allocated, IAS 36 sets out a benchmark ‘relative value’ approach for re-apportioning the goodwill within that unit, while also permitting some flexibility. Similar guidance applies when an entity reorganises its reporting structure – if the reorganisation changes the composition of one or more CGUs to which goodwill has been allocated, the goodwill needs to be reallocated to the affected units.

In our view, an alternative method of reallocation would be appropriate when the relative value approach does not take into account relevant differences between reorganised units (because the relative value approach assumes that each CGU has the same proportion of goodwill).

For example, assume an entity reorganises from three to two CGUs and the assets and activities of the third CGU (CGU C) are integrated with the remaining two (CGUs A and B). CGU C includes allocated goodwill of CU300 which must now be reallocated to CGUs A and B. Under the benchmark approach the reallocation would be based on the relative values of the portions of CGU C that are integrated into CGUs A and B. However, assume also that the portion of CGU C integrated with CGU A is a manufacturing operation and the portion integrated with CGU B is a service-based operation. Using the figures in the table below, the relative value basis would result in the allocation of CU150 to CGU A and CU150 to CGU B. The entity may deem it more appropriate in this case (given the different nature of the activities integrated into CGUs A and B) to allocate goodwill based on the notional goodwill of each portion resulting in an allocation of CU60 to CGU A (100/500*300) and CU240 to CGU B (400/500*300).

| On date of reorganisation | Portion of C integrated with CGU A | Portion of C integrated with CGU B | Total |

| Fair value of assets | 500 | 200 | 700 |

| Fair value of portion | 600 | 600 | 1,200 |

| Notional goodwill | 100 | 400 | 500 |