-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

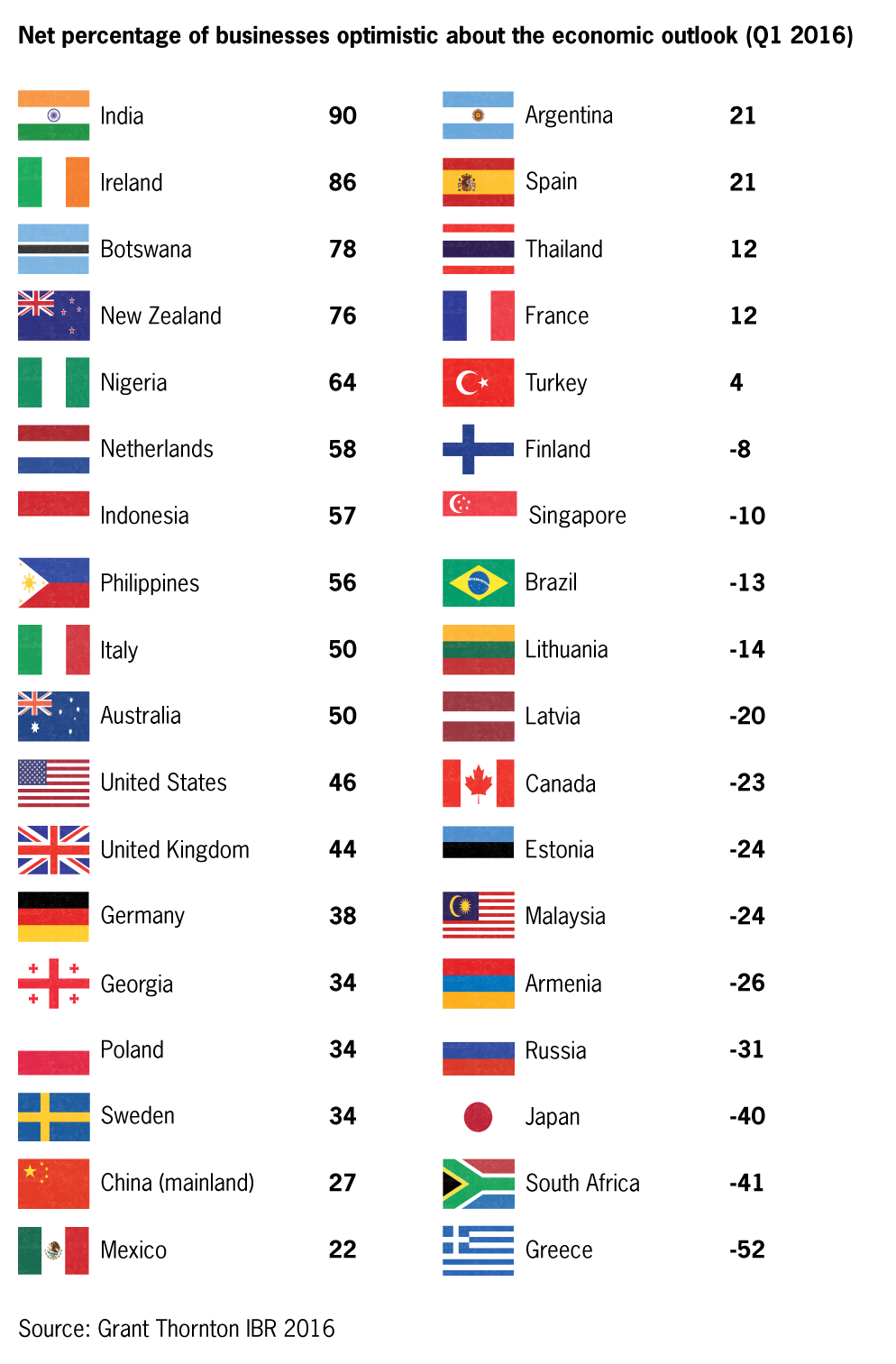

Our latest International Business Report (IBR) research reveals that global business optimism has fallen to a three-year low in the first quarter of 2016. A potent combination of fragile financial markets, volatility in oil prices, concerns over terrorist attacks and regional issues including the prospect of a Brexit and the US Presidential race means the majority of regions have reported uncertainty in their economic outlook. Expectations for revenue, exports and R&D investment have also fallen. We urge businesses to look beyond the current uncertainty and continue to invest for future growth.

Our research reveals that global business optimism fell to net 26% in Q1, the lowest quarterly figure since Q4 2012. The trend is evident across the globe, including the G7 (down 7 percentage points in Q1), EU (down 4pp), North America (down 6pp), Latin America (down 16pp) and Asia Pacific (down 10pp).

The second consecutive quarterly fall in optimism among businesses in the US (50% in Q4 to 46% in Q1) appears to be impacting the sentiment in neighbours Canada (down 41pp) and Mexico (down 32pp) this quarter, while the fall in the UK (73% to 44%) is the largest of any EU member state.

The findings come despite many fundamentals in the global economy remaining steady since the turn of the year. Official figures show that unemployment rates have continued to nudge down in many major economies including the US and Germany, while retail figures also remain strong across Europe and North America.

Businesses feel caught in a tangled web of pressures. The risk of a Brexit, uncertainty over the US presidential election, fears about terrorism, volatility in financial markets or the fall in oil prices present challenges individually, but when combined have a dizzying effect. This is as sober a measure of business sentiment we’ve seen since the global economy returned to post-crisis growth. However, we’ve not seen a major economic jolt in the first quarter which could have triggered this drop in optimism.

There is a risk we could talk ourselves into a downturn when in fact, moments like this present longer-term opportunities. A common feature in the stories of the most dynamic and successful firms is that they don’t let the noise from these external factors out of their control distract them from looking at their own operations, and they continue to invest in the pursuit of growth years down the line. That may appear easier said than done at the moment, but without investment now, businesses will find themselves behind the curve when conditions overhead improve.

The IBR reveals that 35% of businesses globally expect to increase revenue over the next 12 months – the lowest figure since Q2 2012. At the same time, just 13% of businesses expect to export more over the coming year, which is the lowest figure recorded since we began surveying quarterly in 2010.The same is true of Research & Development (R&D) plans; just 18% of firms globally plan to boost R&D spend in the next 12 months.

However, our figures do reveal a glimmer of hope in the shape of consumer spending power. With inflation rates low, nearly one in five (19%) firms globally plan to award employees an above-inflation pay rise this year – the highest figure ever recorded.

For businesses navigating their way through choppy waters, the priority should be sticking to their intended course. Focusing on R&D may seem less attractive when revenue and export targets look less achievable, but in fact this is exactly the time when trusting your instinct and making those investments can ultimately reap the biggest rewards.