-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

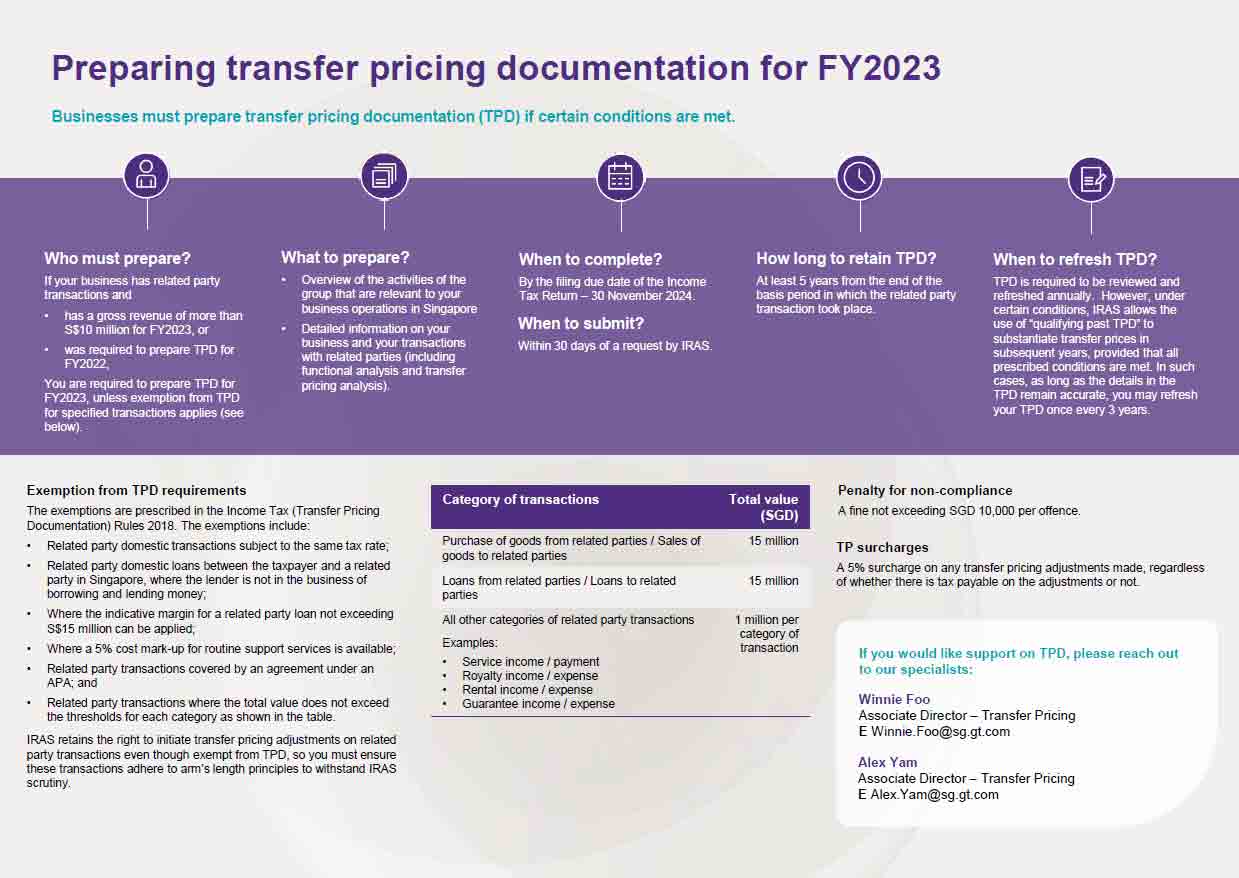

#1 Mandatory requirements

From the year of assessment (YA) 2019 onwards, unless exemption from TPD for specified transactions applies (see further on point 4), Singapore taxpayers must prepare TPD when either of the following two conditions are met:

- The gross revenue from their trade or business for the basis period concerned is more than SGD 10 million, or

- They were required to prepare TPD for the previous basis period.

#2 Purpose and importance of TPD

TPD is crucial for taxpayers to demonstrate that their related party transactions are conducted at arm’s length. Together with inter-company agreements, TPD serves as the primary defence during transfer pricing audits.

If the taxpayer is unable to show with their TPD that their transfer pricing is at arm’s length or they do not have TPD to substantiate their transfer prices, it can lead to several adverse consequences:

- If IRAS determines that the taxpayers have understated their profits through improper transfer pricing, they will make upward transfer pricing adjustments.

- In cases of double taxation resulting from transfer pricing audits by IRAS or foreign tax authorities, IRAS may not support the taxpayer in Mutual Agreement Procedure (MAP) discussions to resolve the double taxation.

- Applications for Advance Pricing Arrangement (APA) agreements may be rejected by IRAS.

- For transfer pricing adjustments made by IRAS for YA2019 or later, a surcharge of 5% will be imposed on the adjustments, regardless of whether there is tax payable on the adjustments (see further on point 10).

- Failure to comply with TPD requirements under Section 34F of the Income Tax Act 1947 (ITA) and the Income Tax (Transfer Pricing Documentation) Rules 2018 (TPD Rules), can result in fines (see further on point 9).

These consequences have the potential to disrupt business operations and damage a company’s reputation.

#3 Documentation requirements

Taxpayers are advised to adhere to the content requirements outlined in the TPD Rules when preparing their TPD, which include:

- Group-level information: An overview of the businesses of the group that is relevant to the taxpayers’ business operations in Singapore; and

- Entity-level information: Detailed information on the taxpayers’ business and their transactions with related parties, including functional analysis describing the functions performed, assets used and risks assumed by each party to each related party transaction and transfer pricing analysis to support the transfer prices applied.

#4 Exemption criteria

Taxpayers with gross revenue from a trade or business not exceeding SGD 10 million for the relevant basis period, or when not specifically requested by IRAS, are generally exempt from preparing TPD.

However, if taxpayers who are required to prepare TPD experience declining revenue such that their gross revenue is consistently below SGD 10 million, they will be exempted from preparing TPD if their gross revenue is not more than SGD 10 million for that basis period and the immediate two preceding basis periods.

For taxpayers who are required to prepare TPD under Section 34F of the ITA but are not eligible for the gross revenue exemption, a secondary check is applied to assess if TPD can be exempted for specific transactions under the TPD Rules. These specified transactions include:

a. Related party domestic transactions subject to the same tax rate;

b. Related party domestic loans between the taxpayer and a related party in Singapore, where the lender is not in the business of borrowing and lending money;

c. Where the indicative margin can be applied for a related party loan not exceeding SGD 15 million;

d. Where a 5% cost mark-up for routine support services is available;

e. Related party transactions covered by an agreement under an APA; or

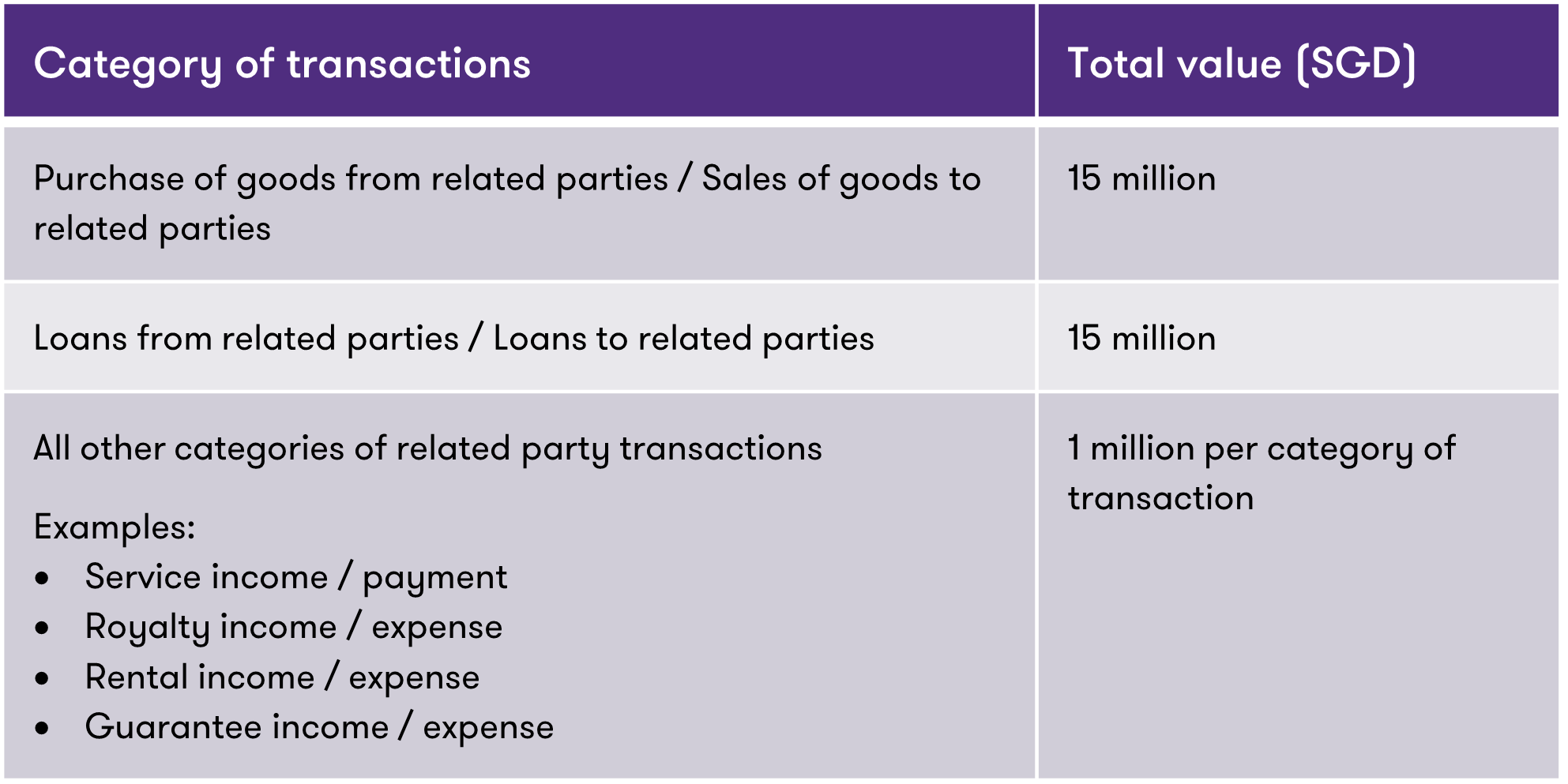

f. Where the total value or amount of all the related party transactions (excluding those mentioned in points (a) to (d) above) in the basis period concerned do not exceed the thresholds for each category as shown in the following table:

#5 Timing of TPD preparation

TPD must be completed by the filing due date of the Income Tax Return.

#6 Submission of TPD

Taxpayers are not required to submit their TPD when filing a tax return. However, they must submit their TPD within 30 days of a request from IRAS.

#7 TPD refreshment

Taxpayers are expected to review and refresh their TPD annually.

However, under certain conditions, IRAS allows the use of “qualifying past TPD” to substantiate transfer prices in subsequent years. To be regarded as “qualifying past TPD”, the TPD must meet the following criteria:

- The underlying transaction(s) in the subsequent financial period must be the same as those for which the TPD was prepared;

- The underlying transaction must involve the same related party in the subsequent financial period;

- The TPD must contain documentation of group level and entity level information, in accordance with the TPD Rules;

- The TPD must be prepared in English and include the date of preparation; and

- The following aspects between the taxpayer and related parties in the TPD must remain unchanged:

- Commercial or financial relations between related parties and taxpayers;

- The conditions made or imposed between related parties and taxpayers;

- Transfer Pricing methodology; and

- Arm’s length condition as defined in Section 34D of the ITA.

#8 Retention period

Taxpayers should retain TPD for at least 5 years from the end of the basis period in which the related party transaction took place.

#9 Penalties for non-compliance

Non-compliance with the TPD requirements may result in penalties not exceeding SGD 10,000 per offence. These offences include:

- Failure to prepare TPD by the time for the making of the tax return;

- Failure to prepare TPD with the details and in the form and content as prescribed by the TPD Rules;

- Failure to retain TPD for a period of at least 5 years;

- Failure to submit TPD within 30 days from a request by IRAS; and

- Providing TPD that is false or misleading.

#10 TP surcharges

In cases where IRAS initiates transfer pricing adjustments, a 5% surcharge is imposed on the adjustments, regardless of whether there is tax payable on the adjustments made.

IRAS retains the right to initiate transfer pricing adjustments on related party transactions exempt from TPD, so taxpayers must ensure these transactions adhere to arm’s length principles to withstand IRAS scrutiny.

Under certain circumstances, IRAS may grant a full or partial remission of the surcharge. These circumstances include co-operative and responsive behaviour of taxpayers, maintenance of contemporaneous TPD and good tax compliance records.

Conclusion

We encourage taxpayers to take a proactive approach to managing their transfer pricing risks by preparing contemporaneous TPD. During the preparation of such documentation, there is often an opportunity to identify further risk mitigation strategies. By proactively managing their transfer pricing risks and ensuring proper documentation, taxpayers can mitigate these risks and maintain good tax compliance.

Subscribe for timely technical updates and keep on the pulse with industry developments