-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

A debate is raging among mid-market business leaders as to what COVID-19 means for their exports and international supply chains. Shutdowns have caused major disruptions internationally, but also in local markets. So, should companies’ sales and supply focus be more domestic or more international? Are overseas markets an unnecessary risk or a smart hedge?

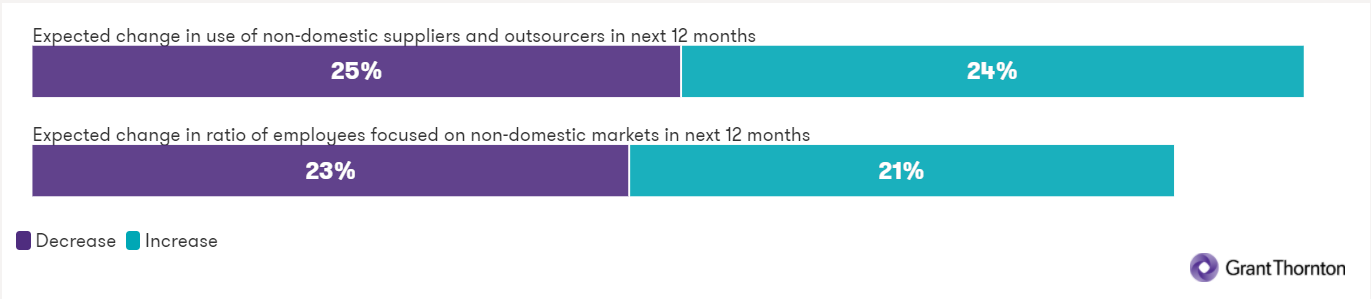

The conflicting opinions are revealed in our research into resilience in the mid-market, conducted in May and June. For the first time, we asked companies about their prioritisation of international markets and supply chains in the next 12 months. We found that most companies are looking to change how they prioritise these two related areas, but there is a startling level of disagreement as to whether to increase or decrease their international focus. At a global level and by a slim majority the intention is to decrease prioritisation of international sales and supply chains, although there’s plenty of variation across geographies and sectors.

The results chime with what we’ve seen in our longer-running tracking of export expectations among mid-market companies, which showed export expectations for H1 2020 falling but not by as much as other growth measures, with a slim majority of 27% expecting to decrease exports in the coming year, compared with 25% expecting an increase.

Globalisation is not dead

The continued prioritisation of international markets – and the fact that around three-quarters of mid-market businesses sell goods or services abroad – is a timely reminder that “Globalisation is not dead. It may just look a little different. International trade is such an important part of the mid-market universe and may provide opportunities where domestic markets are struggling,” notes Francesca Lagerberg, Global leader – network capabilities at Grant Thornton International Ltd.

Factors such as business models, leadership and market opportunities will inevitably influence the importance that companies attach to international sales and supply chains. Usefully, our analysis finds the rule of thumb is that international supply chains are prioritised as much or as little as international sales: those prioritising international sales also prioritise international supply chains, and vice versa.

Geographically, the more developed regions of Asia Pacific, Western Europe and to some degree North America are currently shifting their sales and supply focus back towards domestic markets, while emerging regions remain more internationally focused. This could have significant economic impacts on the global economy depending on the scale and speed of these changes. The relatively early hit by COVID-19 to many developed countries during the IBR research months of May and June explains some of this pullback, while continued optimism and importance of trade may explain the resilient global focus of emerging markets.

At sector level, there are nuances aplenty. Sectors which are at the very heart of the national interest, like healthcare, education and transport are certainly seeing more domestic focus, as are consumer sectors like travel, tourism and leisure and consumer products. In many countries, restrictions and concerns about international travel have seen domestic tourism surge. And COVID-19 is also having some indirect impacts on demand.

Trefor Griffith, head of food and beverage (F&B) at Grant Thornton UK LLP, observes that “During lockdown, consumers have been recognising that there are things that they can do to help the environment – like buying locally and reducing the amount of travel – and this has boosted domestic demand.” He notes that sustainability isn’t a new trend in F&B, but its progress has been accelerated by COVID-19.

Trefor Griffith, head of food and beverage (F&B) at Grant Thornton UK LLP, observes that “During lockdown, consumers have been recognising that there are things that they can do to help the environment – like buying locally and reducing the amount of travel – and this has boosted domestic demand.” He notes that sustainability isn’t a new trend in F&B, but its progress has been accelerated by COVID-19.

Internationalisation is still firmly on the agenda for many sectors. Technology, media and telecoms has always been very global in its sales and supply chain focus, and it tops the list of sectors looking to further prioritise international markets in the next year. Among the other sectors looking to grow their international focus are financial services, and construction and real estate.

Trefor reminds business leaders that COVID-19 hasn’t fundamentally changed the considerations for businesses when deciding to internationalise products. “You still need to work out who would want to consume the product and whether you can get it there at a price they will pay. You still need to do the diligence to make sure it will be a success, then plan, plan and plan and make sure you have the right support to execute your strategy.”

COVID-19 amplifies pre-existing supply chain challenges

When it comes to thinking about supply chains, it’s important to recognise that COVID-19 is just the latest in a long line of shocks to international supply chains. The escalation of the US-China trade war already had many businesses thinking about supply chain disruption and how best to deal with this. Last year, we noted that having multiple supply chains was as critical as ever and identified that some companies were adopting a ‘China plus two or three’ strategy for greater resilience, establishing secondary suppliers in multiple countries.

“This amplifies the supply chain issues that we have already seen and I think it is accelerating decision-making around supply chains. People are now thinking ‘we have got to bring it home – or closer to home’,” says Rodger. A closer to home shift could inevitably favour the lower costs countries in Europe, Asia Pacific and the Americas. But he cautions that a significant recalibration of supply chains will require real investment at a time where finance is much less accessible, and that the speed and scale of changes may depend on government incentives.

Business leaders have certainly shown a desire to improve the resiliency of their supply chains, with more than one-third globally saying that this is something they will need to address after the Covid-19 crisis.

Scott Wilson, advisory director at Grant Thornton International Ltd, advises against any knee-jerk decision-making and stresses the importance of considering multiple factors when thinking about international supply chains, such as the political and economic stability of the markets, taxation, availability of suitable labour supply, the cost base, intellectual property protection, the regulatory environment and the security of access to raw materials.

Scott Wilson, advisory director at Grant Thornton International Ltd, advises against any knee-jerk decision-making and stresses the importance of considering multiple factors when thinking about international supply chains, such as the political and economic stability of the markets, taxation, availability of suitable labour supply, the cost base, intellectual property protection, the regulatory environment and the security of access to raw materials.

Robert suggests that a more fruitful supply chain move might be away from single or multiple providers towards strategic partnerships. “These partnerships would be much more flexible, and rather than locking you into one country, one supplier or a set allocation, would allow you to turn things on or off at different levels in the supply chain according to shifting situations and needs.”

While fundamental changes to supply chains will be a consideration for some, the question for many is whether to abandon a just-in-time approach to production and instead focus on building up raw materials and finished stock to counter any future disruptions – a ‘just-in-case’ approach. While some level of excess may be sensible for now, Francesca advises against a fundamental departure: “Just-in-time is not a thing of the past. The pandemic has made this more complicated, but the efficiency and margin advantage to a business of just-in-time have been so important for businesses. New business models may emerge from the pandemic but it will still be important to keep what works from the past.”

Scenario planning is the best way to ride out volatility

All our leaders stress the importance of scenario planning in helping businesses to work out the best way of dealing with the immediate challenges of COVID-19 on international sales and supply chains. “Those that have thought about the ‘what if’ questions will have worked out plan Bs to allow them to be agile and resilient. Businesses that want to manage their risk profile and be well positioned to take advantage of opportunities must engage in effective scenario planning,” says Scott.

For the medium to longer term, Scott notes that businesses will need to keep re-evaluating their international footprints. “As the impact of COVID-19 dissipates, factors like flexibility, reliability, cost and the market opportunity will continue to be important considerations for businesses seeking growth – with a purely domestically-focussed strategy being a limiting, and for some, unsustainable strategy.”

Contact a Grant Thornton adviser in your location to discuss COVID-19 and what it means for your international sales and supply chains.

Robert Hannah

Robert Hannah