Singapore’s small and medium-sized enterprises (SMEs) are the unsung heroes of the nation’s economy. In 2024, SMEs represented 99% of all enterprises and employed nearly 70% of the workforce. Their sheer scale means that any national ambition, whether economic or environmental, must place SMEs at its heart.

As Singapore pursues its Green Plan 2030 and upholds its commitments under the Paris Agreement, the role of SMEs in environmental, social, and governance (ESG) transformation is pivotal. For the government to achieve its climate goals, it is not enough only for large corporations to decarbonise; the vast network of SMEs must also be brought on board.

This article, a joint collaboration between Grant Thornton Singapore and Singapore Computer Society, analyses the state of ESG readiness among participating Singapore companies. The paper aims to juxtapose the Singapore ESG mid-market experience with our global counterparts through a wider sustainability study focused on global mid-market companies conducted by Grant Thornton International in 20251. Grant Thornton had derived our Singapore-centric insights from a free-to access questionnaire named EAST (ESG Assessment for Sustainability Transformation), which had been used since the beginning of 2025.

The urgency of ESG adoption

Singapore’s commitment to Paris Agreement means everyone has a role to play

Singapore has been an active and committed participant in the global climate effort since ratifying the Paris Agreement on 21 September 2016. Demonstrating leadership for a city-state, Singapore submitted its initial Nationally Determined Contribution (NDC) and Long-Term Low-Emissions Development Strategy (LEDS) ahead of the COP26 summit. A major milestone was reached in 2022 when it unveiled its enhanced national target to achieve net zero emissions by 2050, formalising this commitment in an updated NDC.

To materialise this ambition, Singapore launched the Singapore Green Plan 2030, a comprehensive national roadmap with concrete sectoral targets.

The Singapore Green Plan 2030 is a whole-of-nation initiative to move Singapore towards our national targets. Its wide-ranging sectoral approach – City in Nature, Energy Reset, Green Economy, Resilient Living and Sustainable Living – means every segment of the Singapore economy and society will be impacted.

More regulations are expected to frame the new Singapore economy

In support of the national drive towards sustainable building, regulatory pressures are mounting. The Singapore Carbon Pricing Act, for example, covers over 80% of national emissions and will inevitably affect SMEs’ operating costs as their carbon tax increase along the government’s stated trajectory. As of 20 January 2026, carbon tax had been raised from $5 per tonne (2019-2023) to the current $45 per tonne (2025-2027). The government plans to ultimately increase the carbon tax to $50 to $80 per tonne by 2030. On top of that, more regulations are also expected, and SMEs must prepare for changes that could directly impact their margins and business models.

SMEs: Singapore cannot achieve our national ESG goals without our mid-market firms

For Singapore, SMEs are not only numerous but essential. With 354,600 SMEs compared to just 1,400 non-SMEs, their dominance is clear. They employ nearly 2.5 million people, fundamentally shaping Singapore’s social and economic landscape.

While large corporations have long embraced sustainability – with workforces generally familiar with ESG concepts and internal programmes designed to drive change – their efforts alone are insufficient. Studies indicate that approximately 70% of large companies’ emissions fall under Scope 3, meaning they originate from their supply chains and partners. Therefore, multinationals cannot achieve significant decarbonisation without the active participation of SMEs. Increasingly, these large firms are requiring their suppliers to integrate sustainability into their operations, making ESG adoption a commercial imperative for SMEs. Those who lag risk being excluded from vital supply chains and market opportunities.

This imperative is also recognised by in a global study conducted by Grant Thornton International. When asked which operational goals could be more easily achieved through greater sustainability, the top choice among mid-market businesses was improving supply chain operations (53.8%). Firms in banking (64.9%), private equity (64.7%), and technology (65.5%) were particularly positive about sustainability’s impact on their supply chains. This is likely because these sectors operate extensive, global networks: technology companies often source and ship components from numerous countries, whilst banking and private equity rely on international flows of capital.

The state of ESG among Singapore SMEs

Assessment and performance

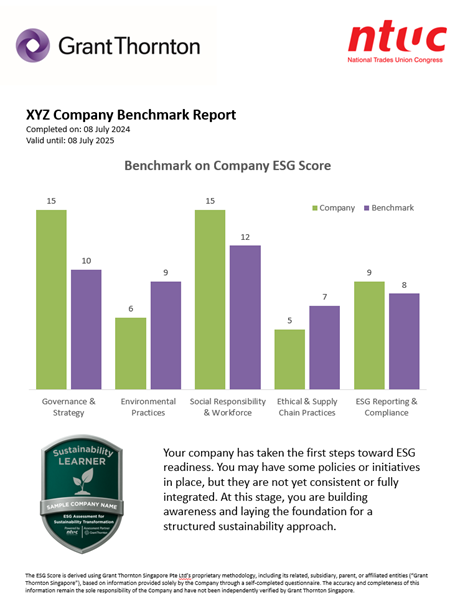

In 2025, Grant Thornton Singapore and NTUC collaborated to launch the ESG Assessment for Sustainability Transformation (EAST). EAST measures sustainability across five verticals: governance and strategy, environmental practices, social responsibility and workforce, ethical and supply chain practices, and ESG reporting and compliance. Respondents are ranked from Sustainability Beginner to Sustainability Champion.

EAST was designed to be accessible online and a light-weighted self-served questionnaire which not only collects information and derived insights about Singapore SMEs’ ESG readiness but it also provides SMEs with insights into how they are benchmarked against their peers – other SMEs located in Singapore.

The latest survey of over 66 Singapore-based companies reveals an average ESG score of 69%. Among the assessed areas, environmental practices – scoring 65% – emerged as the weakest, with nearly 70% of SMEs yet to integrate ESG considerations into their supply chain and procurement.

While the study showed that social responsibility is better understood (72%) among Singapore SMEs, it is often applied informally rather than through structured policies. For instance, Grant Thornton worked with one well-managed, multi-generational SME where employees remained loyal for decades, despite the absence of a formal comprehensive medical coverage plan. In practice, the owner consistently provided personal care and financial support to any worker who fell ill or was injured. This example highlights that social commitment does exist within SMEs, but often operates on an ad-hoc basis.

Our findings show that ESG reporting and compliance remain uncommon among SMEs. This is likely because most SMEs are not subject to mandatory sustainability reporting, and voluntary disclosure is still limited. Although many recognise that larger corporations are increasingly requesting such information from their suppliers, most SMEs lack both the obligation and the expertise to produce credible ESG reports.

Overall, Singapore’s SMEs are still in the early stages of their ESG journey, particularly in areas like decarbonisation and sustainable supply chain practices. That said, they perform well in governance and ethical practices—both scoring 69%—reflecting a strong foundation of prudence and accountability in organisational management.

Global perspective: How mid-market firms compare

Comparing these findings to global trends, Singapore’s SMEs appear more cautious than their global counterparts. Grant Thornton International research shows that 85.9% of mid-market firms worldwide intend to increase or maintain their investment in sustainability in 2025, with 54% believing it will boost long-term profitability. Market competition and brand reputation are cited as key drivers. However not all are the same – in Asia and North America, only about half of firms share this optimism, while European businesses remain the most positive about the benefits of sustainability investment.

Looking ahead, many respondents globally expect regulations to become more accommodating in the short term, reflecting the geopolitical and economic uncertainties of early 2025. Yet, the consensus is that, as the world strives to catch up on sustainability targets, rules will eventually tighten. SMEs that act early will be better positioned to adapt and thrive.

Challenges and opportunities for Singapore SMEs

Barriers

Cost remains a significant barrier, with 40.9% of mid-market firms citing it as the main obstacle to sustainability initiatives. Complexity of regulations and resource constraints are also frequently mentioned. These challenges are not unique to Singapore, but their impact is magnified by the scale and diversity of the SME sector.

Opportunities

Despite these hurdles, the opportunities are substantial. ESG adoption opens doors to new markets, partnerships, and investor interest. Structured ESG practices can help SMEs become preferred partners for MNCs, and early adoption positions SMEs to adapt smoothly as regulations evolve. Competitive advantage, supply chain integration, and regulatory readiness are within reach for those who commit to the journey.

Recommendations: Getting started with ESG

- Leverage digital tools: Use platforms like EAST for tailored ESG assessments and benchmarking.

- Structured social impact: Move from informal to measurable social responsibility initiatives.

- ESG reporting: Build capacity for voluntary reporting, even if not mandated, to meet stakeholder expectations.

- Seek professional guidance: Engage with mid-market specialists like Grant Thornton for right-sized, purpose-driven ESG projects.

- Prepare for regulatory change: Anticipate stricter rules and position your business for resilience and growth.

Singapore’s SMEs are at a crossroads. Their economic weight and employment impact make them central to the nation’s sustainability ambitions. By embracing ESG, SMEs not only future proof their businesses but also contribute meaningfully to Singapore’s climate commitments and global reputation. The journey may be challenging, but with the right tools, guidance, and mindset, Singapore’s SMEs can lead the way in sustainable growth.

This article is also available on Singapore Computer Society's website here.

[1] “Scaling sustainability - How the mid-market is future-proofing growth” Grant Thornton Internation 2025, https://www.grantthornton.global/en/insights/sustainability/scaling-sustainability/#6259001____The-sustainability-scene