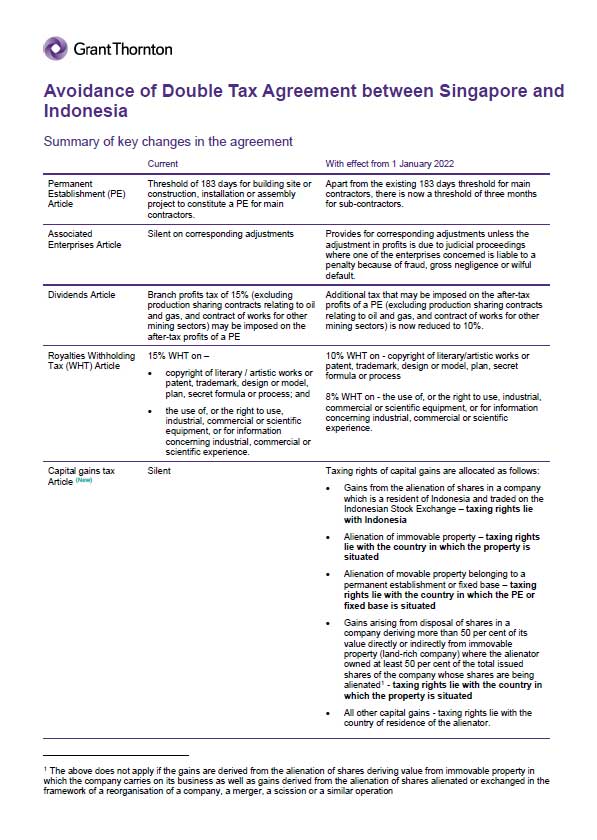

The tax treaty, signed more than 30 years ago, has been updated on 4 February 2020 and was ratified in 2021. This update reflects both countries’ commitment to engage in continuous dialogue on tax matters and to take into account latest developments in the international tax arena.

Mitigating abuse of the DTA

The insertion of the anti-abuse provision under the new article 26 reflects the commitment of both countries to ensure that the purpose and intent of tax treaties should not be abused for tax avoidance or double non-taxation. Likewise, the updated exchange of information (EOI) article reflects the current climate in the light of Base Erosion and Profit Shifting Initiatives where collaborative exchange of information may reduce the incidence of tax treaty abuse.

Among the updates, the amendment to grant the taxing rights of gains on disposal of shares in private companies in Indonesia to Singapore is a significant change for Singapore tax resident investors, which we discuss below.

Clarity around Indonesian capital gains tax

The new capital gains tax article has made it explicit that the taxing rights relating to any gain on the disposal of shares in non-land-rich private Indonesian companies are ceded to the country of residence of the alienator, ie, Singapore. A “land-rich” company is one that derives more than 50% of its value, directly or indirectly, from property situated in Indonesia.

Even gains made on the disposal of shares in a land-rich private Indonesian company are taxable in Indonesia only if the Singapore seller owns 50% or more of the issued share capital of the Indonesian company in question.

Currently, the Indonesian withholding tax of five percent is payable on the gross proceeds from a sale of shares in a private Indonesian company, irrespective of the composition of its asset base, and regardless of whether there is an actual gain made from the sale. With the impending change, the taxing right will henceforth be with Singapore.

Please note that this exclusion from capital gains tax for the disposal of private companies in Indonesia also does not extend to the disposal of shares of companies listed on the Indonesian stock exchange. Such gains will continue to be subject to Indonesian domestic withholding tax of 0.1%[1]

Provided the seller of the shares is not carrying on a share dealing business in Singapore (such that his gains are capital in nature), then taken together, a Singapore tax resident company that invests in Indonesian private companies may make such gains without suffering any tax in either Indonesia or Singapore.

This position, is however, contingent on the two factors, namely

- Tax residency of the Singapore company

The Singapore company must be able to obtain a Singapore certificate of tax residence from the Inland Revenue Authority of Singapore. From a Singapore perspective, residency is determined by the place in which the business of a company is controlled and managed. “Control and management” is the making of decisions on strategic matters. In practice, where this is exercised is a question of fact. There are additional conditions to be met if the Singapore company is a foreign-owned investment holding company (ie, 50% or more of its shares are ultimately owned by companies incorporated outside Singapore or individual shareholders who are not citizens of Singapore).

- Tax profile of the Singapore company

Singapore does not impose tax on capital gains. However, gains from the disposal of shares may be construed to be of an income nature and subject to Singapore income tax. Generally, gains on the disposal of shares are considered income in nature and sourced in Singapore if they arise from or are otherwise connected with the activities of a trade or business carried on in Singapore.

Having said that, there is a safe-habour rule that grants exemption on the gain on disposal of shares. Subject to meeting certain conditions, gains derived by a resident company from the disposal of ordinary shares, made between 1 June 2012 and 31 May 2027 (both dates inclusive), are not taxable if, immediately prior to the sale, the divesting company had held at least 20% of the ordinary share capital in the investee company for a continuous period of at least 24 months. Please note that the safe harbour rule does not apply to companies that, amongst other conditions, “…principally carries on the activity of holding immovable properties situated whether in Singapore or elsewhere …”.

With proper records of the tax residency status of the Singapore company as well as the nature of the gains on the disposal, it may be possible for the Singapore tax resident company not to have to pay tax in either country in respect of investment in private companies in Indonesia that does not involve real estate.

However, where real estate is involved, the Singapore tax treatment of the gains derived from the disposal remains a grey area as the concept of “principally carries on the activity of holding immovable properties situated whether in Singapore…” under the Singapore tax law, is subject to interpretation.

[1] This rate excludes disposal of founder’s shares where the withholding tax rate is 0.6%.