Global mobility solutions

Setting up an equity compensation plan – Legal and Tax Considerations

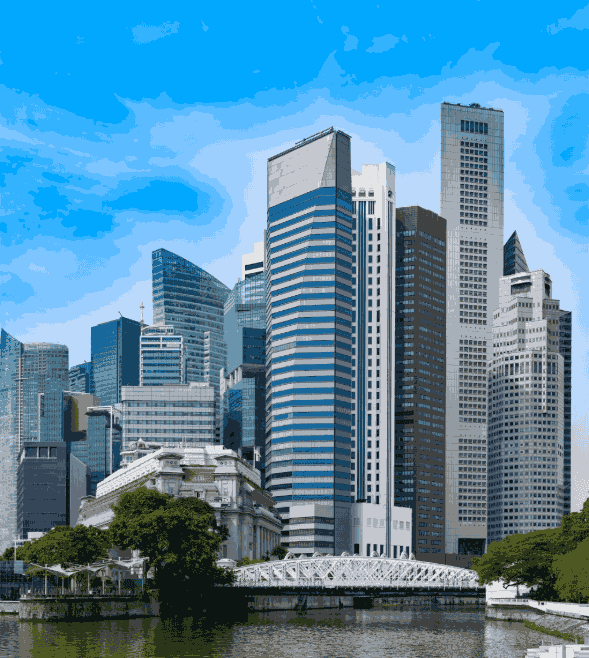

Equity-based incentive plans have gained significant traction in Singapore as a tool to attract, retain and reward employees. These plans allow employees to share in the company’s success, aligning their interests with shareholders while also deferring part of the company’s expenses. SGX-listed (i.e. public) companies have long used these structures, and private companies, including startups, now increasingly adopt them for their flexibility and impact on long-term motivation of employees.