-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

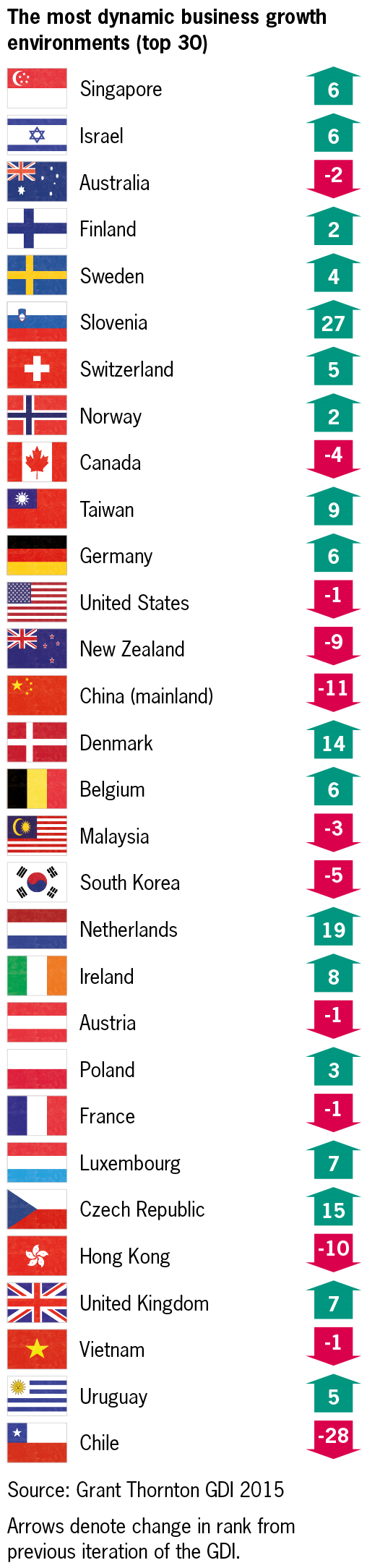

Singapore, Israel, Australia have beaten global competition to top the latest Grant Thornton Global Dynamism Index (GDI) which ranks the business growth environments of 60 leading economies.

These countries offer dynamic businesses the right mix of regulatory stability, a strong labour market, technological infrastructure, growth opportunities and access to finance. However, comparing these results with the perceptions of business leaders about operating in different markets, suggests misconceptions could be stifling future international growth prospects.

Singapore (rank 1) leads the GDI 2015, rising six places from the previous iteration. It ranks top for financing environment and no lower than 25 (economics and growth) in any other growth area, highlighting the country’s robust, broad-based offer to dynamic businesses.

Israel (rank 2) has also risen six places this year. It comes top for technology due to strong research and development spending, and in the top 10 for financing environment. Australia (rank 3=) drops two places but still ranks in the top five for business operating environment and labour market. Finland (rank 3=) and Sweden (rank 5) have both risen slightly, due to their favourable business operating environments and an advanced technology infrastructure.

Paul Raleigh, global leader - growth and advisory services, said: “Market entry decisions are some of the toughest a business leader ever has to face. There are so many factors - both known and unknown - to consider. Uncertainty about what lies ahead can make it hard to make the case for action to colleagues and funding partners, and to manage risk effectively.

“The GDI can be used as a tool to help identify countries of interest by drawing on 22 indicators weighted according to the importance attached to them by real business leaders, adding that vital human perspective.”

Perception vs reality

However, further analysis of the results suggests business leaders may not be fully aware of the drivers and challenges of operating in different markets. Comparing the reality of the GDI with the  perceptions of business leaders from the Grant Thornton International Business Report (IBR) indicates some interesting knowledge gaps.

perceptions of business leaders from the Grant Thornton International Business Report (IBR) indicates some interesting knowledge gaps.

For example, Singapore, ranks top for the overall quality of its financial regulatory system in the GDI, but more than a quarter (28%) of business leaders questioned in the IBR perceive financial uncertainty or risk as a barrier to doing business there. The picture is similar for international investors in Germany where one in five cite financial risk as a barrier despite the country’s sound financial framework (rank 17=).

Paul Raleigh continued: “A lack of familiarity with a particular territory or region can skew perception and lead to unexpected challenges when expanding into a new market. For dynamic businesses, the trick is balancing instinct with reason, perception with reality.

“This study reveals how looking behind the headlines can uncover unexploited opportunities for dynamic businesses in new markets. The business world is always changing, with the realities on the ground often surprising business leaders who take a closer look. In order to maximise growth potential, business leaders need to refresh their perceptions of foreign markets in line with the market insights at their disposal.