-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

Big sporting events key to attracting investment, say emerging economies

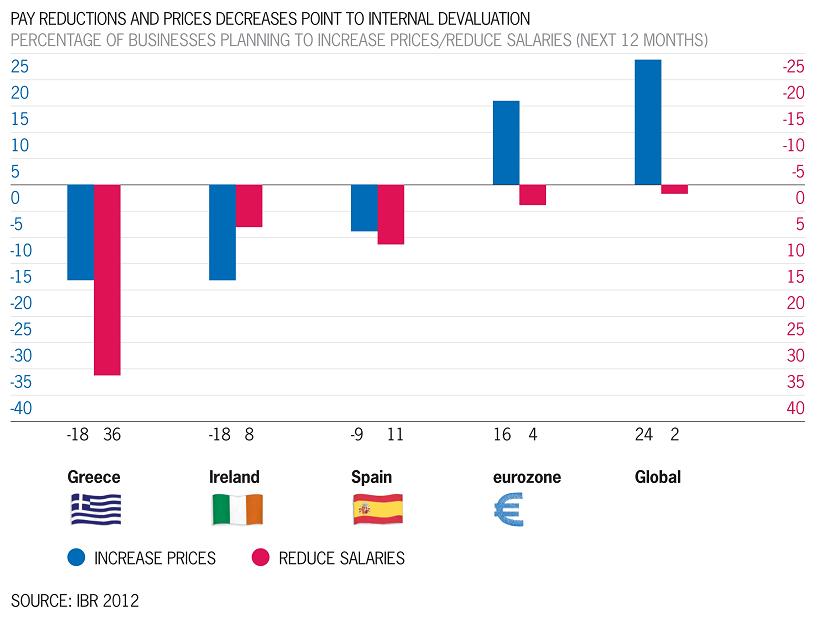

Unable to devalue their currencies as a means to increase the price competitiveness of goods and services, new research shows that the EU bailout economies are showing signs of undergoing a process of internal devaluation. As a consequence of austerity measures and low levels of economic activity, wages and selling prices in these countries look set to fall relative to other economic regions, according to Grant Thornton's International Business Report (IBR) - giving a much needed boost in competitiveness to businesses in those countries.

Lower selling prices

The latest results from the IBR illustrate that, whereas on balance businesses across the world will increase the price they sell goods and services for over the next 12 months, the only region with more price cutters than risers is the EU bailout economies. In this troubled group of economies, which have all now received bailout funds, net -11% plan to increase selling prices over the next 12 months (indicating that 11% more businesses plan to reduce prices than plan to increase them) falling from -3% in the previous quarter. This compares to net 24% globally. In Greece and Ireland this figure is -18% (down from -16% and -4% respectively in Q1), and in Spain -9% (down from 0%). By contrast net 24% of businesses globally will raise the price of their goods and services over the next 12 months. 36% of businesses in the BRIC economies will do so, 33% in North America and 42% in Latin America.

Lower wages

In addition, in EU bailout economies almost no businesses (just 1%) are planning to give above inflation pay rises in the next 12 months. Instead 15% will reduce wages and 49% intend to offer no increase. By contrast just 2% of businesses globally expect to lower salaries over the next 12 months, with 17% planning above inflation wage increases. No businesses in Greece plan to offer pay rises over this period and 36% of businesses expect to reduce salaries. This compares to the 73% of businesses in the BRIC economies planning to offer pay rises at inflation, 19% of which will be above inflation. In North America employers are feeling even more generous; 85% of businesses intend to award pay increases to staff, of which 24% will be above inflation. Even in the European Union as a whole over half of businesses (54%) will raise salaries, 10% at least in line with inflation.

Ed Nusbaum, CEO of Grant Thornton International, said: “Economic conditions in the EU bailout economies are tough right now for businesses and families. Unemployment rates in countries such as Spain and Greece are now well over 20% and austerity measures are biting. Although far from desirable, as a consequence of this we are beginning to see what we are calling a Gre-valuation - an internal devaluation whereby low levels of demand are pushing down prices and wage costs. Although undoubtedly painful, this will give businesses in these regions a competitive advantage when selling goods at home or exporting abroad, given that other nations are set to increase their selling prices.

We are seeing fundamental economic forces at work. This process of austerity leading to lower prices occurred in the Baltic states where Latvia has returned to growth and was recently praised for its achievements by the IMF. It’s not easy or pretty, but this shows it can be done.

Notes to editors

The Grant Thornton International Business Report (IBR) provides insight into the views and expectations of over 12,000 businesses per year across 40 economies. This unique survey draws upon 20 years of trend data for most European participants and 10 years for many non-European economies. For more information, please visit: www.internationalbusinessreport.com .

Data collection

Data collection is managed by Grant Thornton International's core research partner -Experian. Questionnaires are translated into local languages with each participating country

having the option to ask a small number of country specific questions in addition to the core questionnaire. Fieldwork is undertaken on a quarterly basis. The research is carried out primarily by telephone.

Sample

IBR is a survey of both listed and privately held businesses. The data for this release are drawn from interviews with 3,000 businesses from all industry sectors across the globe conducted in May/June 2012. The target respondents are chief executive officers, managing directors, chairmen or other senior executives.

Director of Public Relations and External Affairs

T +1 312 602 8955