-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

What is Pillar 1 in BEPS 2.0

Pillar 1 is intended to reallocate profits and related taxing rights from certain jurisdictions where multinational enterprises (MNEs) have physical substance, to other countries where they have a customer base, regardless of whether they have a physical presence in that second jurisdiction.

To determine the profit allocation to a particular market jurisdiction, Pillar 1 uses two formulas:

- Amount A – This applies to MNEs with consolidated revenue exceeding EUR 20 billion and profitability greater than 10% of revenues. It reallocates a portion of the MNE’s profit to market jurisdictions that satisfy the quantitative nexus test.

- Amount B – This is a fixed remuneration for basic marketing and distribution activities (with no revenue threshold).

Key Summary of Pillar 1 - Amount B report

On 19 February 2024, the OECD published a report on Amount B outlining the process for simplifying and streamlining the application of the arm’s length principle for in-country baseline marketing and distribution activities. This is meant to assist low-capacity jurisdictions1 that often struggle with limited resources and data availability for determining an arm’s length return on those types of activities. The report will form part of the Annexes of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2022 (“OECD TP Guidelines”).

The Inclusive Framework2 (“IF”) is still working on additional qualitative scoping criteria to identify distributors performing non-baseline activities for the purpose of a simplified and streamlined approach, the design elements (i.e., pricing matrix, operating expense cross-check, and data availability mechanism) and the list of low-capacity jurisdictions. This is supposed to be finalised by 31 March 2024 but there has been no updates.

Countries may opt to apply the approach for in-scope transactions from 1 January 2025. Consistent with other optional approaches in the OECD TP Guidelines, it is non-binding on jurisdictions.

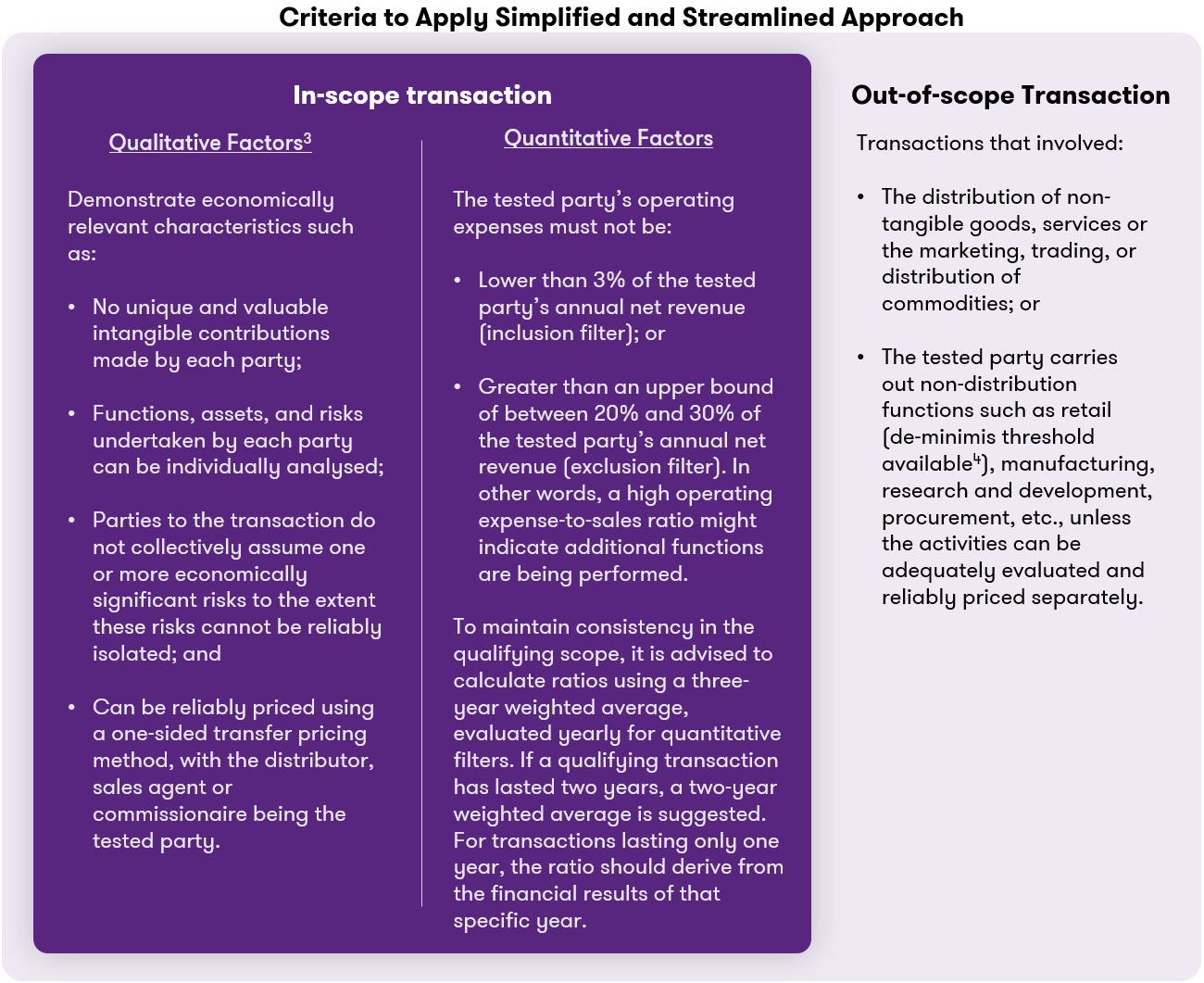

Transactions that are in-scope of Amount B

Qualifying transactions for the simplified and streamlined approach are:

- Buy-sell marketing and distribution transactions: These involve a distributor purchasing goods from associated enterprise(s) for wholesale distribution to unrelated parties; and

- Sales agency and commissionaire transactions: These involve the remuneration of the sales agent or commissionaire to one or more associated enterprises’ wholesale distribution of goods to unrelated parties.

The assessment criteria are outlined below:

Application of the simplified and streamlined approach

The transactional net margin method is considered the most suitable method for pricing in-scope transactions. Nonetheless, the comparable uncontrolled price method may be used if internal data is available and reliable.

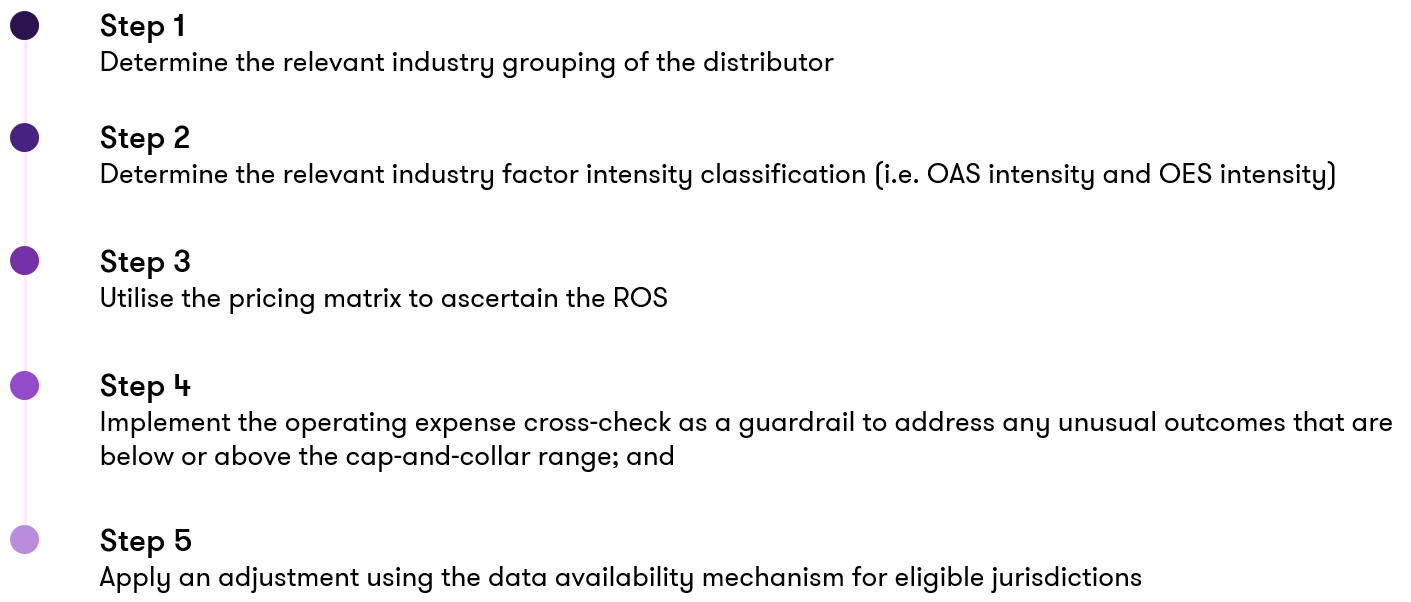

Return on Sales (“ROS”) has been selected as the net profit indicator for pricing the in-scope transactions. Businesses will apply and test the actual outcome of the in-scope transactions on an ex-post basis against the pricing matrix (plus or minus 0.5%) established on three industry groups and five categories of operating asset (“OAS”) and operating expense (“OES”) intensities as illustrated below:  An operating expense cross-check acts as a corroborative guardrail to test whether the ROS provided using the pricing matrix is appropriate, or whether additional adjustments are required. If the ROS determined under the pricing matrix falls outside the following pre-defined operating expense cap and collar range, the ROS will be adjusted to the nearest edge of the range.

An operating expense cross-check acts as a corroborative guardrail to test whether the ROS provided using the pricing matrix is appropriate, or whether additional adjustments are required. If the ROS determined under the pricing matrix falls outside the following pre-defined operating expense cap and collar range, the ROS will be adjusted to the nearest edge of the range.  An additional adjustment is also required based on the in-scope distributors operating jurisdictions’ sovereign credit rating.

An additional adjustment is also required based on the in-scope distributors operating jurisdictions’ sovereign credit rating.

In summary, the processes for determining the approximate arm’s length ROS for an in-scope distributor are as below:

Key takeaways from the Amount B report

It is a welcome development to see the IF trying to alleviate administrative burdens, cut compliance costs, and enhance tax certainty for businesses. However, there is no unanimous decision among IF members that this typically complicated OECD approach will achieve those objectives. As a result, the simplifying and streamlining approach remains elective and non-binding. The final consensus at this point remains unclear. However, we understand already that New Zealand has voted with its feet and said it will not be applying the new option.

Businesses who wish to adopt the approach should first consider the following:

- The approach is still evolving. Additional clarity is required regarding the qualitative factors, such as the criteria to identify distributors performing non-baseline activities, the design elements and the list of low-capacity jurisdictions.

- The approach mainly applies to MNEs engaged in the wholesale trade of tangible goods who employ routine or limited-risk distributors. However, categorising a distributor as "routine" or "limited risk" for transfer pricing purposes does not automatically classify it as a baseline distributor under Amount B, and vice versa.

- The application may not necessarily be simpler than the traditional method of conducting a benchmarking analysis to establish the arm’s length range for baseline distribution activities. The simplified approach mandates a precise definition of the qualifying transaction to verify its applicability, followed by comprehensive quantitative analysis to determine the suitable return garnered by the baseline distributor.

- It will be interesting to see how various jurisdictions choose to implement the approach. We may end up with a divided world, in which some will adopt the Amount B approach and others will not. The outcome determined under the simplified and streamlined approach by one jurisdiction does not bind the counter-party jurisdiction. This aspect will undoubtedly complicate the process, making it a less appealing initiative than it appears. That is unless a majority of jurisdictions opt for its application, ensuring consistency among tax authorities.

[1] The list of qualifying jurisdictions will be fixed prospectively based on those qualifying criteria, published and updated every 5 years on the OECD website.

[2] Consists of 145 countries as of 15 November 2023.

[3] An accurate definition of the functions performed, assets employed, and risks assumed is required to be undertaken in accordance with Chapter I of the OECD TP Guidelines.

[4] Three-year weighted average net retail revenue (excluding distribution of digital goods, commodities, and services) divided by three-year weighted average net revenues > 20%.