-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

In the light of the long (long) awaited birth of the Singapore Variable Capital Company (VCC) in January 2020, and the unexpected facelift announced in the February Budget Statement for Approved Venture Capital Companies under section 13H of the Income Tax Act (ITA), it seems like an appropriate time to do a round-up of where we are with the various options now available for structuring a fund that is managed from Singapore, and how we got here.

Development of the fund management industry

The industry has come an incredibly long way since the early days. Fund management awareness existed in the early nineties, but only in the way perhaps a fly has a dull perception of its own existence. The industry as we know it today really only dates back to 2002. This was when asset management was given a pivotal role in the development of Singapore’s somewhat stalling Financial Services sector, on the back of recommendations from the Economic Review Committee. This was complemented with a loosening of regulation around the ability of foreign fund managers to distribute product(s) in Singapore.

The industry caught a second gust of wind following the recovery of emerging markets from the Global Financial crisis, where a large chunk of locally managed investment was targeted (and where Singapore was perfectly geographically positioned to take advantage). Finally, a revamping, upgrading and consolidation of the regulatory regime by the Monetary Authority of Singapore (MAS) in 2013, put the final feather in the cap of Singapore’s credentials as a serious global player. The city state has thus seen an astounding growth in assets under management, from a nominal blip at the end of the last century, to USD 2.5 trillion and growing, at the end of 2018.

The tax factor

Come on in, the water’s lovely

As a sensible kick-start to the 2002 project, the industry had to attain a critical mass, as well as be competitive with other asset management jurisdictions vying for ascendancy. Astutely, the government first enticed some of the big global players with offers of a zero-tax rate on fee income, provided they brought significant assets under management (AUM) with them. This was followed by a 10% rate of tax under the Financial Sector Incentive - Fund Management (FSI-FM) regime. However, gradually, once enough managers were in the water and showing no signs of wanting to get back out, the exemption was slipped away and the entry barrier for the FSI-FM raised to assets under management (AUM) of $250 million.

What about the fund?

Enticing the manager of course was only half of the story. Managing funds from a base in Singapore has tax implications for the investors or funds they are managing. It meant that the income and gains from investing those funds could be exposed to Singapore tax, irrespective of where the investors were constituted or tax resident. This was on the basis they were carrying on business in Singapore through the agency of the manager.

Complementary then to the incentives for the managers, were safeguards for the funds they were managing, against exposure to Singapore tax.

For any fund to qualify for the tax incentives\safeguards described below, it has to be managed by a fund manager in Singapore. That is, essentially, a fund manager that has a Capital Markets Services Licence, is a Registered Fund Management Company (RFMC) with the MAS, or who falls under one of the other exceptions or exemptions from regulation, e.g. managers of real estate funds.

In addition, only “Specified income” from “Designated investments” is protected. But this includes almost every type of financial transaction you can think of, with the exception of anything to do with Singapore real estate or any unlisted company investing in such.

All at sea

Initially, the thrust was very much aimed at attracting the funds of foreign investors, and the only scheme available was one that protected foreign funds, under (the then) section 13C of the ITA. Many will remember the notorious “80:20 rule” which meant that if the investor content became more than 20% Singapore-based, the whole ship went down, captain and all. Subsequently, offshore trusts were repackaged within the 13C protection that applied to offshore companies to create what we now have - section 13CA. This is often referred to as the “Offshore Fund Scheme” for obvious reasons.

Moving onshore

It was eventually made apparent to the MAS that actually, insisting that the fund entity be constituted and tax resident outside Singapore, also meant ensuring that that is where the whole eco-system of service providers stayed - fund administrators, accountants, auditors, lawyers, tax agents, trustees etc. In what has turned out to be a stroke of genius for the industry, the Singapore Resident Fund (SRF) Scheme, governed by section 13R of the ITA, was introduced in February 2006. This enabled the fund entity to be brought onshore in the form of a Private Limited company. Strings were attached, of course. The benefit of being able to have everything and everybody in one room (or at least within walking distance) as well as to have access to Singapore’s tax treaties, was that the fund had to onshore the fund administration function, as well as commit to a minimum annual spend of $200,000.

Keeping the ship afloat

Thankfully, albeit slightly later in 2007, the 80:20 rule was abolished. This was replaced by a requirement that the fund could not be 100% locally owned, in conjunction with a “Non-qualifying investor” test. The Non-qualifying investor test sought to penalise only those local (primarily corporate) investors who, together with their associates, constituted too large a portion of the fund’s investor base. These investors are now taken aside and dealt with separately, the other investors and the fund continuing unscathed. This was a more equitable approach, which gave the other investors confidence that a Singapore investor was not about to come in and sink the ship. Finally, in Budget 2019, the 100% rule was even dropped.

Some unexpected icing on the cake

But in 2009, the icing was put on the cake. Practically unannounced, the Enhanced Tier Scheme was introduced. This is governed by section 13X of the ITA. This scheme not only sweeps aside the Non-qualifying investor test, but also most concerns about the constitution or tax residence of the fund or its investors. This means that if the fund is set up as a Singapore tax resident company, it can access Singapore’s tax treaties as well. The only noticeable qualifying condition in addition to those imposed by the SRF Scheme was the need for AUM of $50 million.

And finally, some attempted resuscitation

Finally, the latest addition to the stable – or rather attempted revival of a neglected existing member of the section 13 suite – came in Budget 2020, where changes to section 13H were announced. The thrust of the enhancements is to broaden the scope of the incentive to embrace partnerships and foreign companies, as well as the VCC. The scheme will also be expanded to include relevant items of the Specified Income from Designated Investments list applicable to the other fund incentives. However, it is expected that the fund strategy will have to remain almost entirely Singapore-centric.

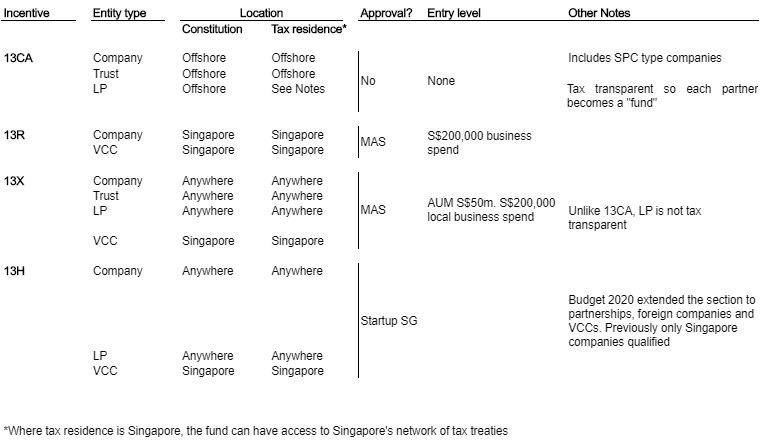

So, we now have: an Offshore Fund Scheme (13CA); a Singapore Resident Fund Scheme (13R); an Enhanced Tier Fund Scheme (13X); and an Approved Venture Capital (entity) Scheme (13H).

Let’s take a closer look now at the type of investment vehicle appropriate to each.

The constitution of Funds

Typically, fund entities will include companies, limited partnerships (LPs), and trusts, which need no introduction.

New kid on the block

We now of course have access to the VCC, which is perhaps a bit of a misnomer, since it ignores, arguably, its principal attraction – the ability to have legally segregated portfolios embedded in it. These entities have been around in other jurisdictions for a number of years, perhaps most notably in the Cayman Islands in the guise of the Segregated Portfolio Company. The beauty of the VCC is that it is treated as a single unit, rather than a series of sub-funds. This means some economies of scale can be achieved through single investment and other service provider agreements. It also means that for tax incentive purposes, the $200,000 spending requirements and $50 million AUM requirements only need be applied once, and not to each sub-fund. Finally, as effectively a Singapore company, it can have access to Singapore’s tax treaties.

But not every fund constitution fits every incentive and vice versa. The following table provides a summary of the typical structures, together with how each might fit into the various tax exemptions.

But then there are the regulatory considerations.

Regulatory options for the fund manager

In tandem with the growth of options for fund type and tax incentives, has been an evolution in the regulatory landscape, and thus the types of manager regarded as a “fund manager” for the purposes of obtaining tax incentives for the fund. Without going into detail, this now encompasses the following regulated and unregulated managers:

Regulated

- Capital Markets Services Licence holder

- Registered Fund Manager

- Venture Capital Fund Manager (subset of CMS Licence, only with lower entry level requirements, but investment restrictions)

Unregulated

- Single Family Office Fund Manager

- Real Estate Fund Manager

Incentives by entity type and location

Quite a matrix

As the above discussion will have revealed, the permutations available for structuring and managing a fund from Singapore should now be capable of meeting almost every need. Putting those pieces together in a coherent and efficient way can, of course, be quite bewildering when you consider the pros and cons of each. These revolve around not only tax, but also location (timezone, distance from service providers), constitution (i.e. ease of governance, liquidity) and regulation (freedom, reputation). So, best not to try this at home.

We trust this article has provided some overview as to what is now available and how we got here. It only of course scratches the surface….